Fund Profile

NAV ($)

$12.802

2025/08/29

Currency

CAD

Monthly Distribution ($)

N.A.

Management Fee

Negotiable

Risk Meter *

Yield (%)

N.A.

Pool Highlights

Investor Suitability

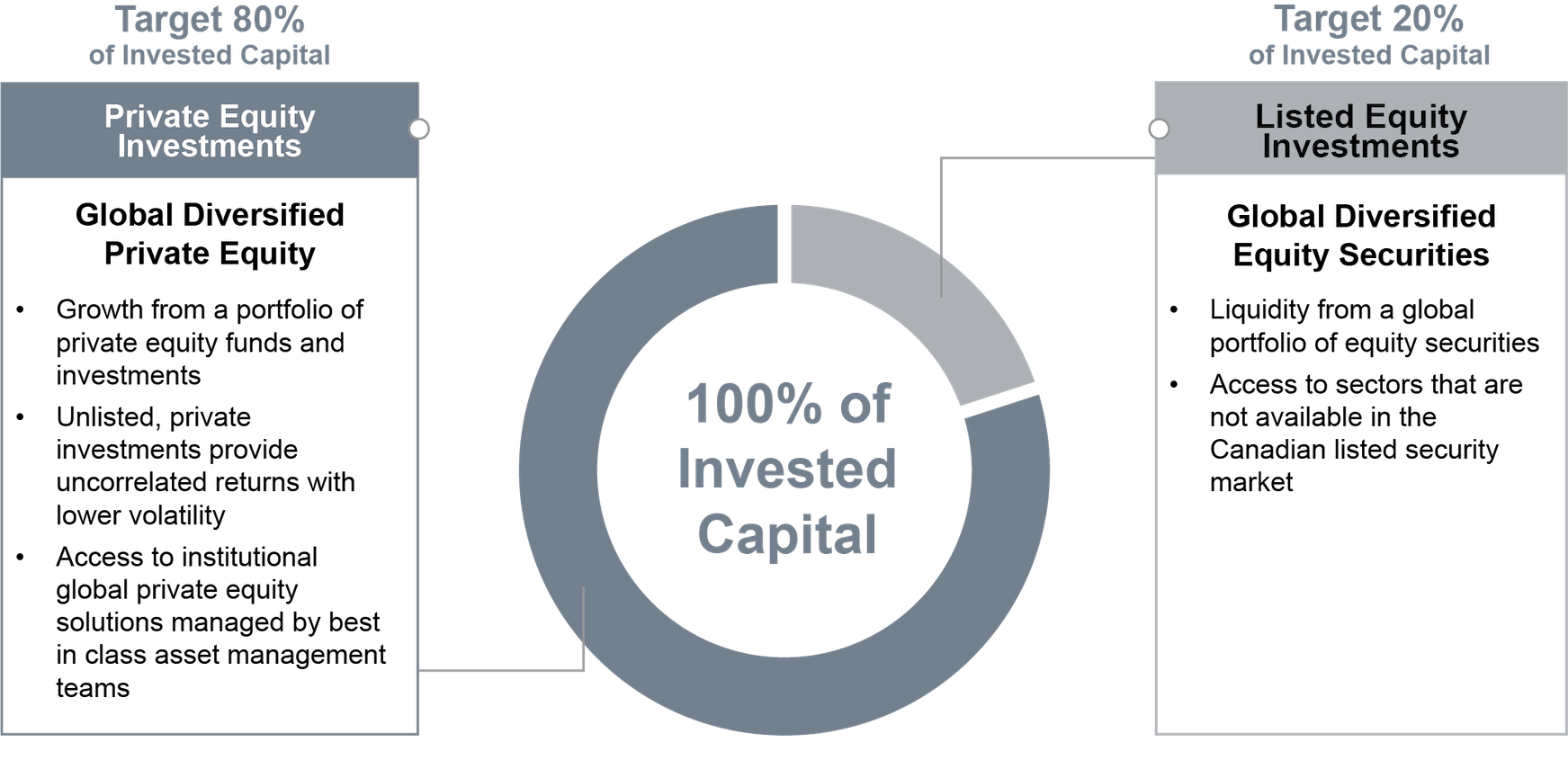

- Attractive long-term capital appreciation potential

- Uncorrelated returns with the potential for less volatility from a global portfolio of diversified global private equity investments

- Access to a concentrated portfolio of listed global private equity investments managed by an investment team with over 30 years of experience

Pool Objectives

The investment objective of the Starlight Global Private Equity Pool is to achieve long-term capital appreciation by investing in a diversified global portfolio of private equity investments and publicly traded global equity securities.

Pool Facts

Fund Code

SLC1904

Currency

CAD

Distribution Frequency

N.A.

Investment Type

Private Pools

Registered Investment Eligible

Yes

Total Number of Holdings

2

Active Share1

New fund

Minimum Investment

Negotiable

Investment Management Team

Dennis Mitchell MBA, CFA, CBV

Chief Executive Officer and Chief Investment Officer

Fund Tenure

2022-09-30

Read Bio >

*Where this is a new fund, the risk rating is only an estimate by Starlight Capital. Generally, we determine the risk rating for each fund in accordance with a standardized risk classification methodology in NI 81-102 that is based on the fund’s historical volatility as measured by the 10-year standard deviation of the returns of the fund. Standard deviation is a common statistic used to measure the volatility and risk of an investment. Funds with higher standard deviations are generally classified as being more risky. Just as historical performance may not be indicative of future returns, a fund’s historical volatility may not be indicative of its future volatility. You should be aware that other types of risk, both measurable and non-measurable, also exist.

1Unitholders have the right to redeem units of the Trust on the last business day of each calendar quarter. Payment of redemption proceeds will be made within 60 days following the applicable quarterly redemption date. Units held for less than 12 months will be subject to an early redemption fee equal to 3% of the Units redeemed.

2Net of accrued management fees and all fund expenses.

Starlight Investments Capital LP (“Starlight Capital”) is the manager of the Starlight Private Global Real Estate Pool, the Starlight Private Global Infrastructure Pool, and the Starlight Global Private Equity Pool (“Starlight Private Pools”). Starlight Private Pools are offered only to “accredited investors” or in reliance on another exemption from the prospectus requirement.

Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with investment funds. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the offering memorandum before investing. Investors should consult with their advisors prior to investing. The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavor to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Starlight Capital mutual funds, exchange traded funds, offering memorandum funds and structured products are managed by Starlight Capital, a wholly-owned subsidiary of Starlight Investments. Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.

Are you an accredited investor?

Starlight Private Pools are offered only to “accredited investors” or in reliance on another exemption from the prospectus requirement. By clicking “Accept”, you confirm that you are an “accredited investor” within the meaning of National Instrument 45-106 – Prospectus Exemptions, and in Ontario, within the meaning of Section 73.3 of the Securities Act (Ontario) as supplemented by the definition in National Instrument 45-106, on the basis that you fit within the category of an “accredited investor” as defined therein.

You may be an “accredited investor” if:

- your net income before taxes exceeded $200,000 in both of the last two years and you expect to maintain at least the same level of income this year; OR Your net income before taxes, combined with that of a spouse, exceeded $300,000 in both of the last two years and you expect to maintain at least the same level of income this year;

- you, alone or together with a spouse, own financial assets worth more than $1 million before taxes but net of related liabilities (cash, or certain investments such as public equity or bonds, would be considered liquid/financial assets); or

- you, alone or together with a spouse, have net assets of at least $5 million (for the purposes of the net asset test, the calculation of total assets would include the value of a purchaser’s personal residence and the calculation of total liabilities would include the amount of any liability (such as a mortgage) in respect of the purchaser’s personal residence).

It is your obligation to consult with your financial advisor and/or such other advisors as you deem necessary in making the determination that you meet the definition of “accredited investor”.

Disclaimer

Information pertaining to the Starlight Private Pools is not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of the Starlight Private Pools are made pursuant to their respective offering memorandum only to those investors in jurisdictions of Canada who meet certain eligibility or minimum purchase requirements. Important information about the Starlight Private Pools including a statement of each fund’s fundamental investment objective, is contained in their respective offering memorandum, a copy of which may be obtained from your dealer. Read the applicable offering memorandum carefully before investing. Unit values and investment returns will fluctuate.

Are you an accredited investor?

Unison Acquision Trust is offered only to “accredited investors” or in reliance on another exemption from the prospectus requirement. By clicking “Accept”, you confirm that you are an “accredited investor” within the meaning of National Instrument 45-106 – Prospectus Exemptions, and in Ontario, within the meaning of Section 73.3 of the Securities Act (Ontario) as supplemented by the definition in National Instrument 45-106, on the basis that you fit within the category of an “accredited investor” as defined therein.

You may be an “accredited investor” if:

- your net income before taxes exceeded $200,000 in both of the last two years and you expect to maintain at least the same level of income this year; OR Your net income before taxes, combined with that of a spouse, exceeded $300,000 in both of the last two years and you expect to maintain at least the same level of income this year;

- you, alone or together with a spouse, own financial assets worth more than $1 million before taxes but net of related liabilities (cash, or certain investments such as public equity or bonds, would be considered liquid/financial assets); or

- you, alone or together with a spouse, have net assets of at least $5 million (for the purposes of the net asset test, the calculation of total assets would include the value of a purchaser’s personal residence and the calculation of total liabilities would include the amount of any liability (such as a mortgage) in respect of the purchaser’s personal residence).

It is your obligation to consult with your financial advisor and/or such other advisors as you deem necessary in making the determination that you meet the definition of “accredited investor”.

Disclaimer

Information pertaining to the Unison Acquision Trust is not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of the Unison Acquisition Trust are made pursuant to their respective offering memorandum only to those investors in jurisdictions of Canada who meet certain eligibility or minimum purchase requirements. Important information about the Unison Acquisition Trust including a statement of each fund’s fundamental investment objective, is contained in their respective offering memorandum, a copy of which may be obtained from your dealer. Read the applicable offering memorandum carefully before investing. Unit values and investment returns will fluctuate.

Are you an accredited investor?

Tower Development Trust is offered only to “accredited investors” or in reliance on another exemption from the prospectus requirement. By clicking “Accept”, you confirm that you are an “accredited investor” within the meaning of National Instrument 45-106 – Prospectus Exemptions, and in Ontario, within the meaning of Section 73.3 of the Securities Act (Ontario) as supplemented by the definition in National Instrument 45-106, on the basis that you fit within the category of an “accredited investor” as defined therein.

You may be an “accredited investor” if:

- your net income before taxes exceeded $200,000 in both of the last two years and you expect to maintain at least the same level of income this year; OR Your net income before taxes, combined with that of a spouse, exceeded $300,000 in both of the last two years and you expect to maintain at least the same level of income this year;

- you, alone or together with a spouse, own financial assets worth more than $1 million before taxes but net of related liabilities (cash, or certain investments such as public equity or bonds, would be considered liquid/financial assets); or

- you, alone or together with a spouse, have net assets of at least $5 million (for the purposes of the net asset test, the calculation of total assets would include the value of a purchaser’s personal residence and the calculation of total liabilities would include the amount of any liability (such as a mortgage) in respect of the purchaser’s personal residence).

It is your obligation to consult with your financial advisor and/or such other advisors as you deem necessary in making the determination that you meet the definition of “accredited investor”.

Disclaimer

Information pertaining to the Tower Development Trust is not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of the Tower Development Trust are made pursuant to their respective offering memorandum only to those investors in jurisdictions of Canada who meet certain eligibility or minimum purchase requirements. Important information about the Tower Development Trust including a statement of each fund’s fundamental investment objective, is contained in their respective offering memorandum, a copy of which may be obtained from your dealer. Read the applicable offering memorandum carefully before investing. Unit values and investment returns will fluctuate.