Value of Advice

Navigating the financial markets on your own and investing with confidence isn’t easy – particularly when heightened volatility has become the norm.

Enlisting the help of a financial advisor is an effective way to ensure your financial goals – as well as your overall financial health – are on the right track.

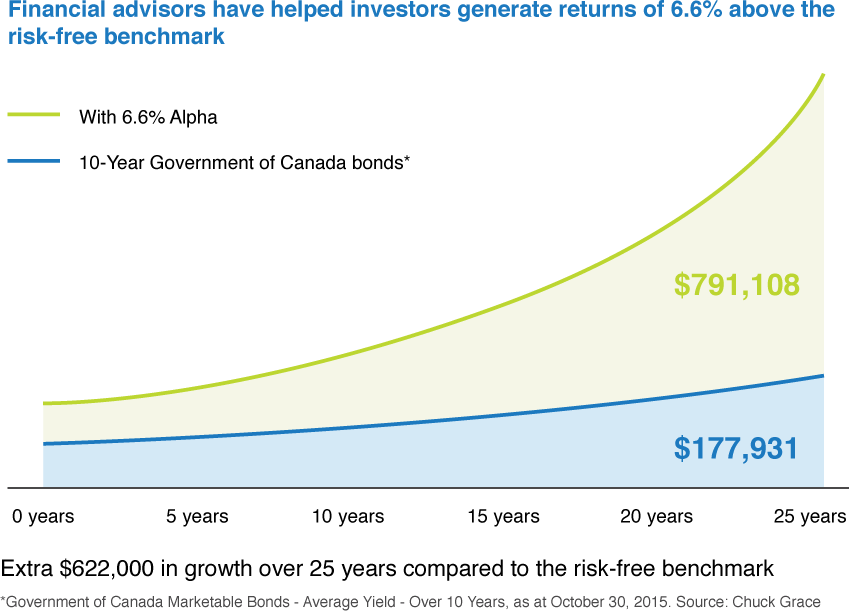

Working with a financial advisor can produce higher investment returns. According to recent data investors who worked with a financial advisor achieved returns of 6.6% above the risk-free rate1 (based on the average of 10-year Government of Canada bonds from January 1, 2001 to December 31, 2010).

Choose the Right Investment Mix to Generate Better Returns

Investors without a financial advisor may invest too conservatively for their age. They may limit their exposure to growth assets, such as equities, that can deliver superior risk-adjusted returns over the long term. The result? These investors can hold too much of low-risk, low-return investments, such as guaranteed investment certificates (GICs) or government-issued bonds. They may not achieve their long-term investment goals.

Financial advisors encourage their clients to invest in equities, and the financial gain can be impressive. With a 6.6% return above the risk-free benchmark (10-year Canadian treasury bills) and a $100,000 investment, an investor could produce an extra $622,000 in growth over 25 years compared with the benchmark. What could that extra growth mean in real life? Post-secondary tuition for 20 grandchildren or a Mediterranean cruise for two every year for 20 years are just two of the many possibilities.

It’s important to remember that short-term volatility can arise when seeking the long-term growth potential of equities and other riskier asset classes. However, over time, the impact of short-term volatility diminishes.

Follow a Disciplined Plan to Save More and Reach Your Long-Term Goals

We live longer lives than ever. The average life expectancy for a 65-year-old is 84 years for a man and 87 for a woman. While that’s great news, a longer life expectancy brings additional financial challenges. How much income will you need to live longer and enjoy the retirement lifestyle you want?

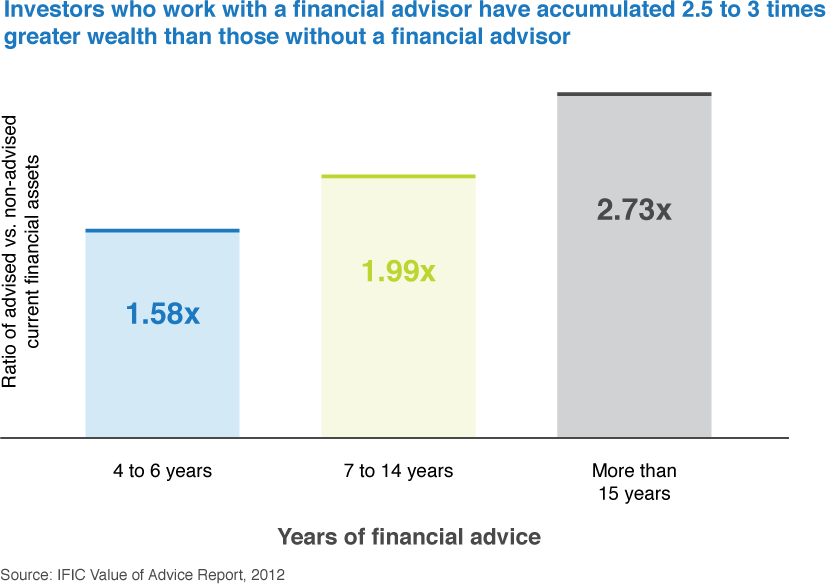

Research shows that investors who worked with a financial advisor for 15 years or more had 2.5 to 3 times more wealth than those who invested without a financial advisor. It’s a significant increase that could mean a world of difference to your comfort before and during lengthy retirement years. Simply put, a financial advisor can help you create a disciplined plan to help you reach your goals and, most importantly, help you stick to your plan.

Control Emotion-Based Behaviours – to Avoid Making Irrational Investment Decisions

When news headlines focus on trouble in financial markets, it’s understandable for some investors to feel anxious and uneasy. They may panic and make investment decisions that could hurt them in the long run. It’s moments like these where financial advisors can help to steer investors away from emotion-based decisions that could jeopardize their long-term financial goals.

Here Are Some Examples of Typical Investor Behaviours, Which an Advisor Can Help You to Avoid:

| Behavior Type | Behavior Description |

|---|---|

| Herd mentality | The tendency to follow the crowd, often chasing returns after they’ve already been achieved. |

| Anchoring | When someone ignores the underlying fundamentals of a business and buys a stock that has suffered a sudden drop in price, solely with the thought that it’s destined to rebound to the previous high-water mark. |

| Loss aversion | The emotional response to market declines (however short term they may be) is dramatically stronger than when markets make gains. Losing money is more painful for people than the satisfaction they experience when making money. |

| Familiarity bias | One way this manifests is in “home country bias,” e.g., when Canadians invest the majority of their assets in the Canadian market even though it makes up only a fraction of the world’s investment universe. |

| Overconfidence | This behaviour occurs when people think they are better at doing something than they really are, or that they can “outsmart” the market. |

Next Steps

Speak with a financial advisor if you’re currently investing in your own. A financial advisor can help you make important changes to your investment portfolio that will support you on your way to achieving your long-term financial objectives.

If you do have a financial advisor, it’s likely you’re already on the right track. But remember: its important for you to tell your advisor of any significant life changes, such as receiving an inheritance or losing your job, that may require an update to your financial plan.