Series T - Designed to Provide Regular Tax-Efficient Monthly Cash Flow

Many investors are seeking solutions that deliver regular, tax-efficient monthly cash flow. Starlight Series T options address this need by offering annual distribution rates of 6% (Series T6) or 8% (Series T8), paid monthly. These options also provide a straightforward way to transition from a long-term growth approach to receiving steady, tax-efficient monthly income.

Series T Offers Four Key Benefits to Investors

01. Sustainable Monthly Distributions

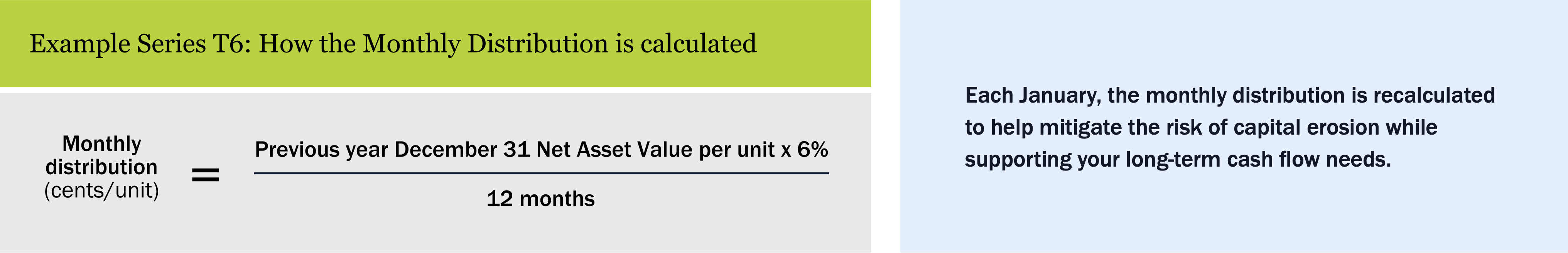

Series T targets an annual payout delivered through equal monthly distributions. The distribution amount is set at the beginning of each year, so you know exactly how much you’ll receive each month. If your fund rises in value, your distribution per unit may increase the following year. If it declines, your distribution may be reduced the following year to re-establish the target payout rate.

Series T targets an annual payout delivered through equal monthly distributions. The distribution amount is set at the beginning of each year, so you know exactly how much you’ll receive each month. If your fund rises in value, your distribution per unit may increase the following year. If it declines, your distribution may be reduced the following year to re-establish the target payout rate.

Each January, the monthly distribution is recalculated to help mitigate the risk of capital erosion while supporting your long-term cash flow needs.

02. Tax-Efficient Income Using Return of Capital

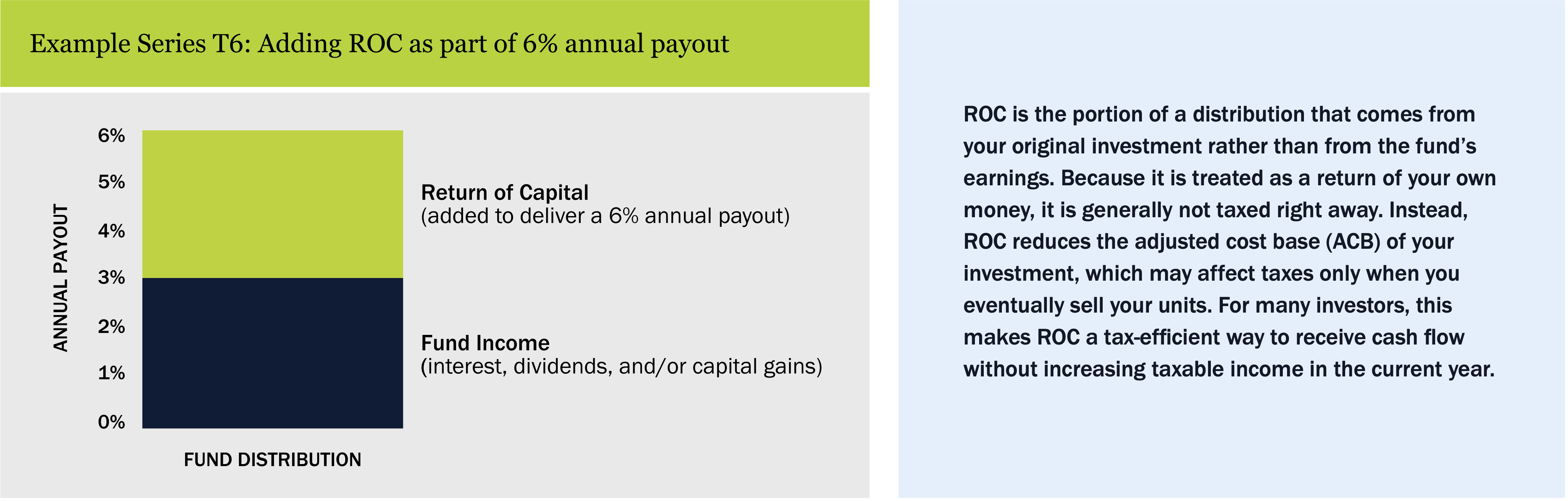

Receiving cash flow through Series T can be more tax-efficient than redeeming part of your investment. To achieve the annual payout rate, the fund combines its income (interest, dividends and capital gains) with return of capital (ROC).

Receiving cash flow through Series T can be more tax-efficient than redeeming part of your investment. To achieve the annual payout rate, the fund combines its income (interest, dividends and capital gains) with return of capital (ROC).

For illustration purposes only. Series T6 may distribute in excess of 6% if special capital gains are distributed at year end. The portion of the distribution that is interest, dividends and/or capital gains will be taxed in the tax year in which it was received.

For illustration purposes only. Series T6 may distribute in excess of 6% if special capital gains are distributed at year end. The portion of the distribution that is interest, dividends and/or capital gains will be taxed in the tax year in which it was received.

ROC is the portion of a distribution that comes from your original investment rather than from the fund’s earnings. Because it is treated as a return of your own money, it is generally not taxed right away. Instead, ROC reduces the adjusted cost base (ACB) of your investment, which may affect taxes only when you eventually sell your units. For many investors, this makes ROC a tax-efficient way to receive cash flow without increasing taxable income in the current year.

03. Easy Transition from Saving to Cash Flow

If you already hold another series of the same fund, you may switch into Series T at any time without triggering a taxable event. This tax-free switch can be particularly helpful as you shift from building your savings to drawing income in retirement. If you have accumulated non-registered assets in a series other than Series T, you can now start drawing on your investments without triggering a capital gain or loss until the investment is ultimately sold.

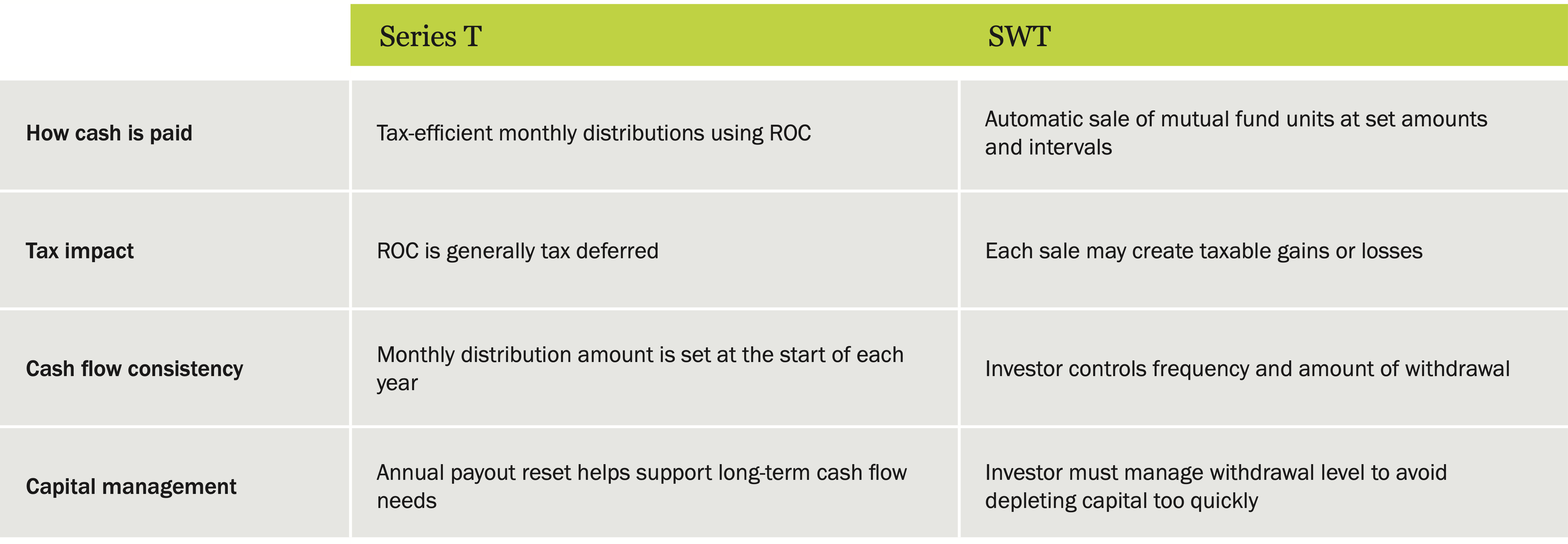

By comparison, a traditional systematic withdrawal plan (SWP) generates cash flow by selling units. Each sale may create a taxable gain or loss, which can increase taxes in the current year. For investors with appreciated investments, receiving part of your monthly cash flow as ROC through Series T6 or T8 could be more tax-efficient.

If you already hold another series of the same fund, you may switch into Series T at any time without triggering a taxable event. This tax-free switch can be particularly helpful as you shift from building your savings to drawing income in retirement. If you have accumulated non-registered assets in a series other than Series T, you can now start drawing on your investments without triggering a capital gain or loss until the investment is ultimately sold.

By comparison, a traditional systematic withdrawal plan (SWP) generates cash flow by selling units. Each sale may create a taxable gain or loss, which can increase taxes in the current year. For investors with appreciated investments, receiving part of your monthly cash flow as ROC through Series T6 or T8 could be more tax-efficient.

Series T vs. Systematic Withdrawal Plan (SWP)

04. Customizable Monthly Cash Flow

You can allocate capital between Series T and other available series of the same fund to customize a monthly cash flow that meets your specific needs up to a fund’s maximum payout rate of 6% (Series T6) or 8% (Series T8) annually.

You can allocate capital between Series T and other available series of the same fund to customize a monthly cash flow that meets your specific needs up to a fund’s maximum payout rate of 6% (Series T6) or 8% (Series T8) annually.

Is Series T Suitable for You?

Series T is suitable for a wide range of investors looking for regular tax-efficient monthly cash flow, but is most appropriate for investors who are:

- Retired or preparing to retire and planning to draw from non-registered investments;

- Looking to establish regular tax-efficient monthly cash flow;

- Expecting to be in a lower tax bracket in future years; or

- Concerned about the clawback of government benefits such as Old Age Security (OAS) pension.

For more information about whether Series T is right for you, speak to your financial advisor today.

1 Payouts may be adjusted as market conditions require; they are not guaranteed. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the rospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.