The Case for Global Infrastructure

The infrastructure sector generally encompasses investments in the underlying networks and services that are essential for the proper functioning of global economies. Historically this has included transportation, energy & utilities, communications and social infrastructure businesses. While the nature of the businesses may differ greatly, there are several common factors which link the businesses and qualify them as infrastructure.

As an asset class, infrastructure is traditional divided between economic and social types of investments.

Types of infrastructure investments

| Economic Infrastructure | Social Infrastructure | ||

|---|---|---|---|

| Transport | Energy & Utilities | Communications | Social |

|

|

|

|

Additional Information

8 reasons for investing in infrastructure

High Barriers to Entry

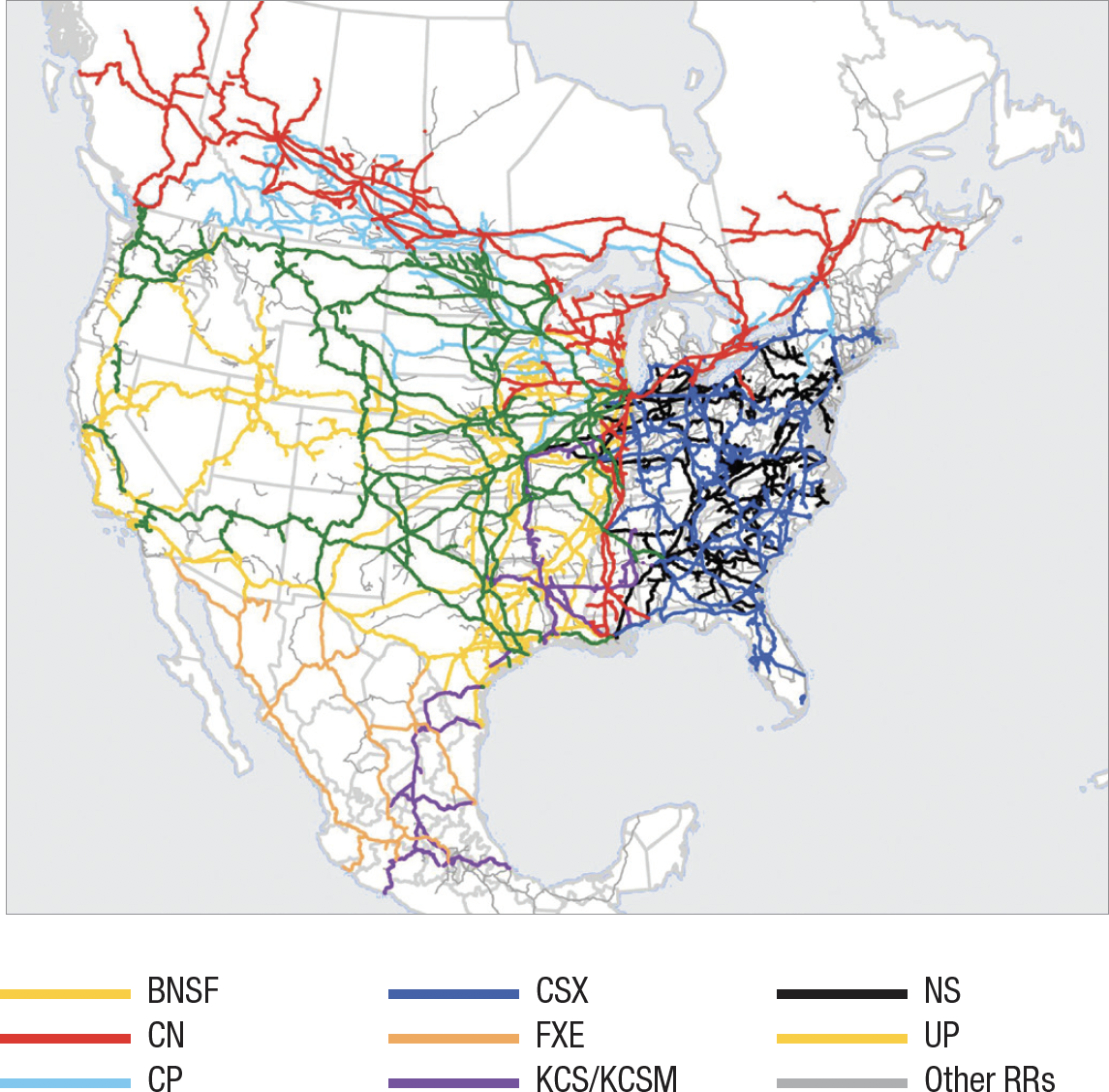

Many infrastructure assets operate as government-regulated monopolies. Utility services providing drinking water or electricity are “mission critical” and the demand for these services is largely inelastic across the business cycle. The exorbitant cost of duplicating water pipes, transmission lines, etc. mean that the public is best served by one provider operating under public oversight.Some infrastructure assets enjoy high barriers to entry as a result of the assets they have acquired or the structure of their industry. International airports enjoy high barriers to entry due to the rapidly declining marginal benefit of building a second large airport in a city. Similarly, the North American freight railroad industry has consolidated into eight large carriers with little prospect of another competing railroad emerging.

Freight Railroads in North America

Pricing Power

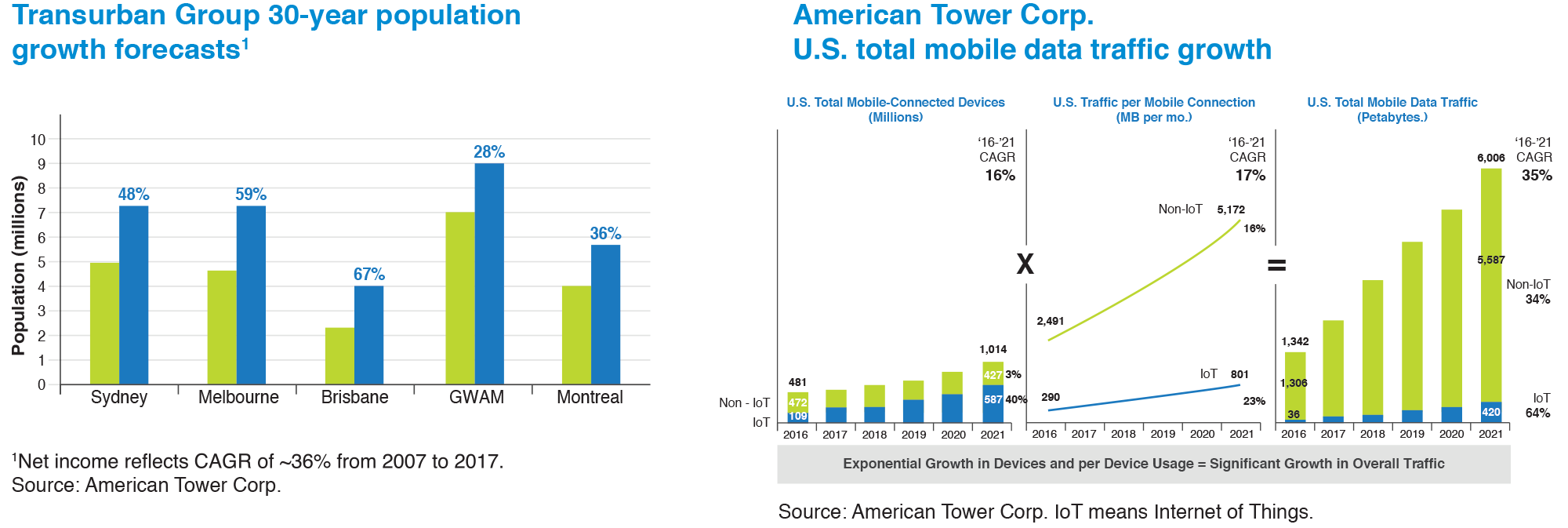

Transurban Group

Tolling Escalation - Embedded Inflation Protection

| MOTORWAY | ESCALATION |

|---|---|

| CityLink | Escalated quarterly by the greater of quarterly CPI or 1.011065% per quarter for the first 16 years (until 31 December 2016), then quarterly by CPI. This is subject to a cap of annual CPI plus 25%, which cannot be exceeded. |

| M2 | Escalated quarterly by the greater of quarterly CPI or 1%. |

| LCT | Escalated quarterly by quarterly CPI. The toll cannot be lowered as a result of deflation, however, until inflation counteracts the deflation the toll cannot be increased. |

| ED | Escalated quarterly by quarterly by the greater of a weighted sum of quarterly AWE and quarterly CPI or 1%. |

| M7 | Escalated or de-escalated quarterly by quarterly CPI. |

| M5 | Escalated quarterly by quarterly Sydney CPI. The toll cannot be lowered as a result of deflation, however, until inflation counteracts the deflation the toll cannot be increased. |

| CCT | Escalated quarterly by: the greater of quarterly CPI or 0.9853% (equivalent to 4% per annum) to June 2012; the greater of quarterly CPI or 0.7417% (equivalent to 3% per annum) to June 2018; quarterly CPI to concession end. |

| Logan Motorway | Tolls escalate annually at Brisbane CPI. The toll cannot be lowered as a result of deflation. |

| Gateway Motorway | Tolls escalate annually at Brisbane CPI. The toll cannot be lowered as a result of deflation. |

| Clem7 | Tolls escalate annually at Brisbane CPI. The toll cannot be lowered as a result of deflation. |

| Go Between Bridge | Tolls escalate annually at Brisbane CPI. The toll cannot be lowered as a result of deflation. |

| Legacy Way | Tolls escalate annually at Brisbane CPI. The toll cannot be lowered as a result of deflation. |

| AirportlinkM7 | Tolls escalate annually at Brisbane CPI. The toll cannot be lowered as a result of deflation. |

| 495 Express Lanes | Dynamic, uncapped. |

| 95 Express Lanes | Dynamic, uncapped. |

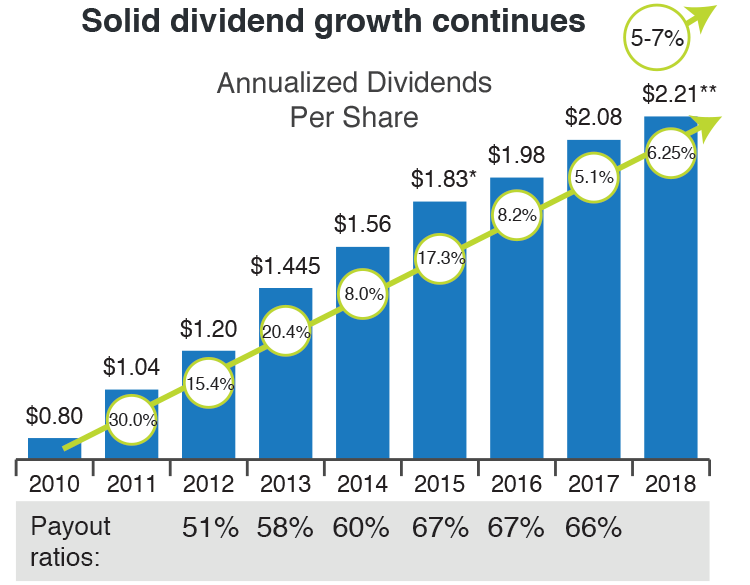

Predictable Cash Flows

WEC Energy Group

**Annualized based on 1st quarter 2018 dividend of $0.5525

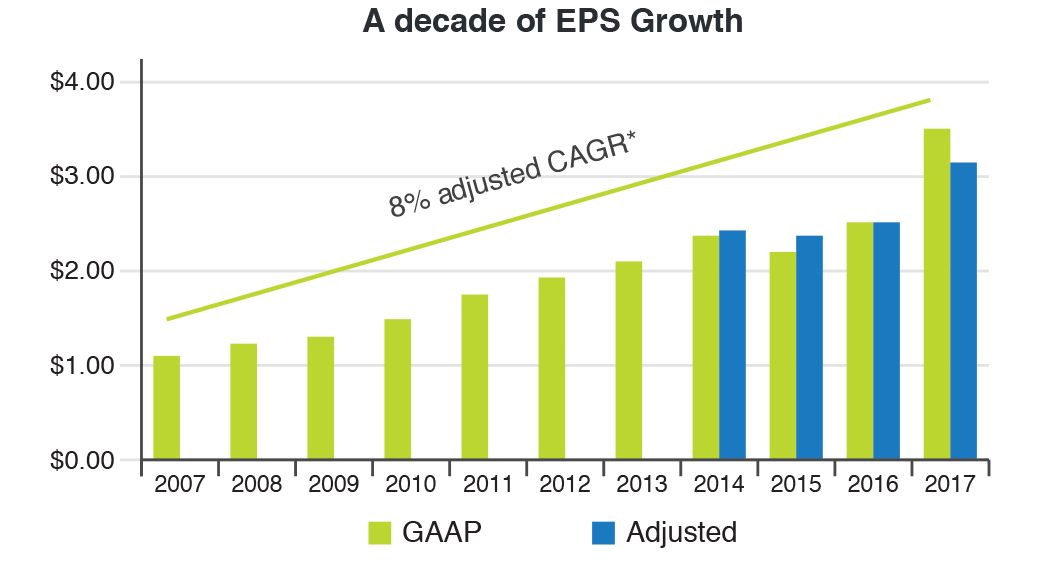

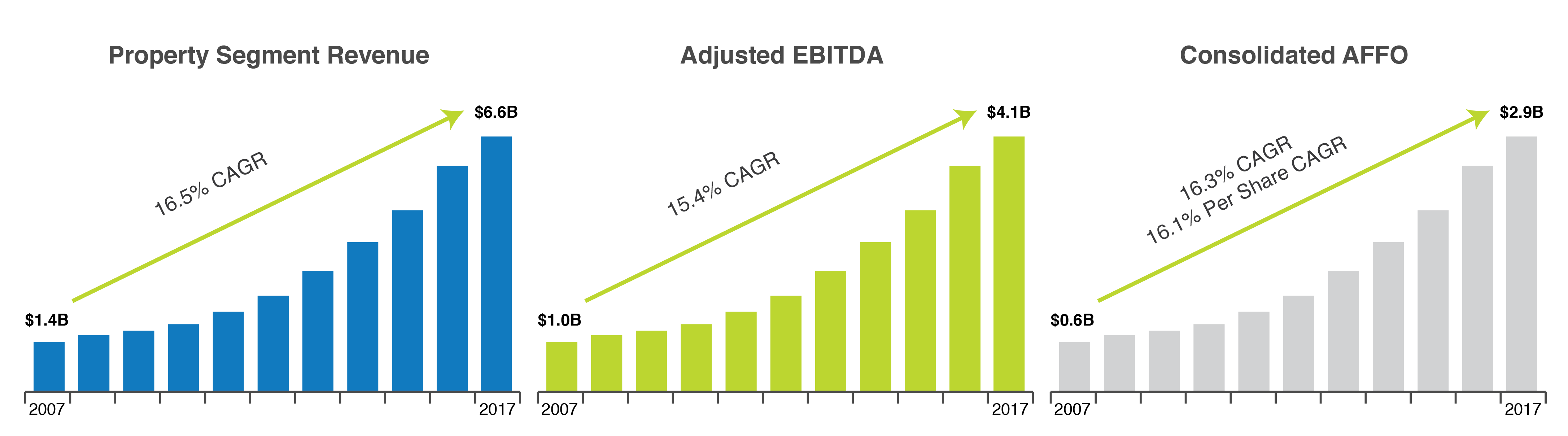

Sustainable Long-Term Growth

America Tower Corp1

Global Macro Drivers

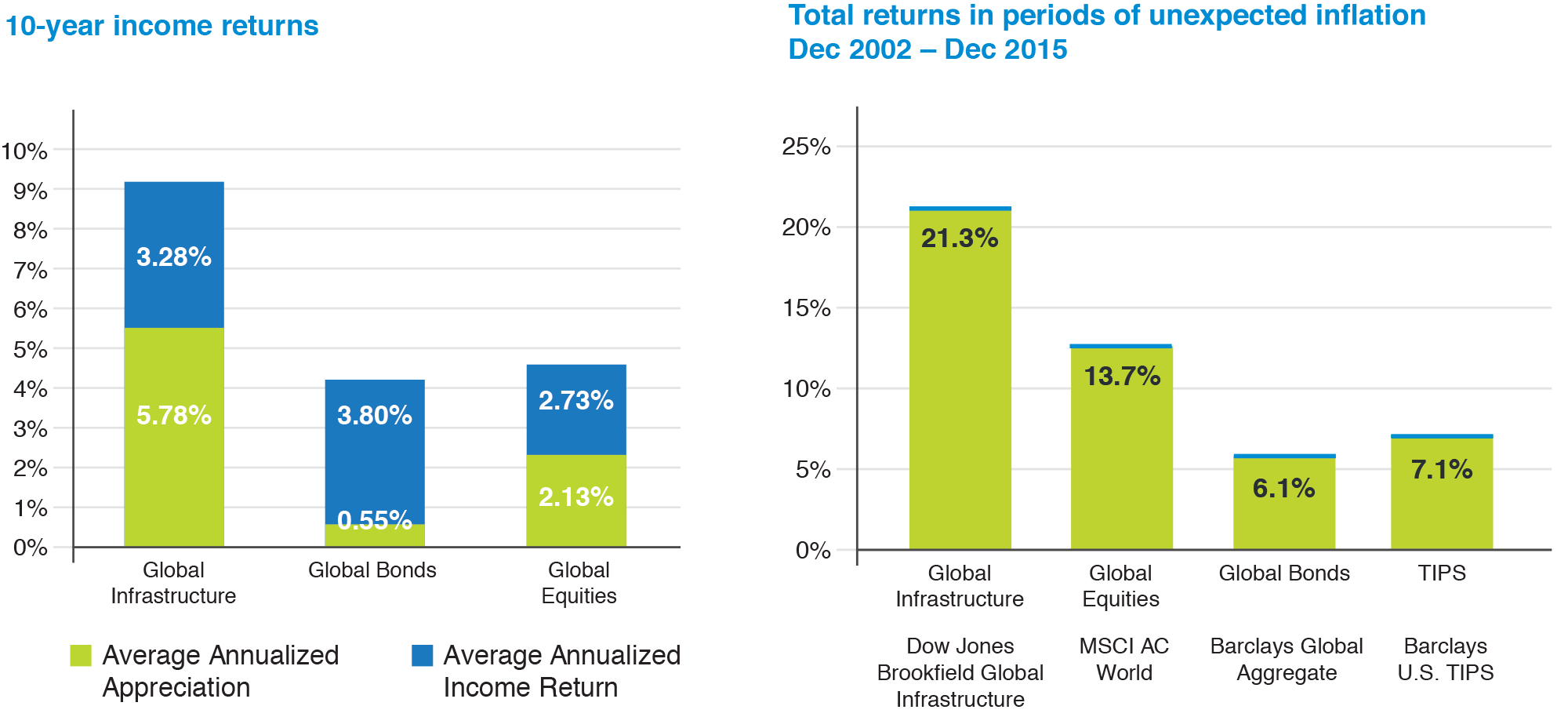

Attractive Total Returns

Low Correlations to Other Asset Classes

| US Equities |

| Non-US Equities |

| Global Bonds |

| REITs |

| Commodities |

| Hedge Funds |

| Inflation-Linked Bonds |

| Private Equity |

| Global Infrastructure |

| Canadian Equities |

| Cash |

| US Equities | Non-US Equities | Global Bonds | REITs | Commodities | Hedge Funds | Inflation-Linked Bonds | Private Equity | Global Infrastructure | Canadian Equities | Cash |

| 1.00 | ||||||||||

| 0.87 | 1.00 | |||||||||

| 0.10 | 0.33 | 1.00 | ||||||||

| 0.62 | 0.62 | 0.29 | 1.00 | |||||||

| 0.31 | 0.43 | 0.22 | 0.17 | 1.00 | ||||||

| 0.67 | 0.76 | 0.26 | 0.48 | 0.51 | 1.00 | |||||

| 0.00 | 0.12 | 0.69 | 0.23 | 0.23 | 0.23 | 1.00 | ||||

| 0.85 | 0.89 | 0.23 | 0.73 | 0.40 | 0.74 | 0.12 | 1.00 | |||

| 0.66 | 0.80 | 0.43 | 0.60 | 0.41 | 0.69 | 0.28 | 0.70 | 1.00 | ||

| 0.80 | 0.82 | 0.25 | 0.53 | 0.58 | 0.79 | 0.17 | 0.79 | 0.67 | 1.00 | |

| -0.16 | -0.10 | 0.05 | -0.07 | 0.00 | -0.01 | 0.04 | -0.18 | 0.05 | -0.07 | 1.00 |

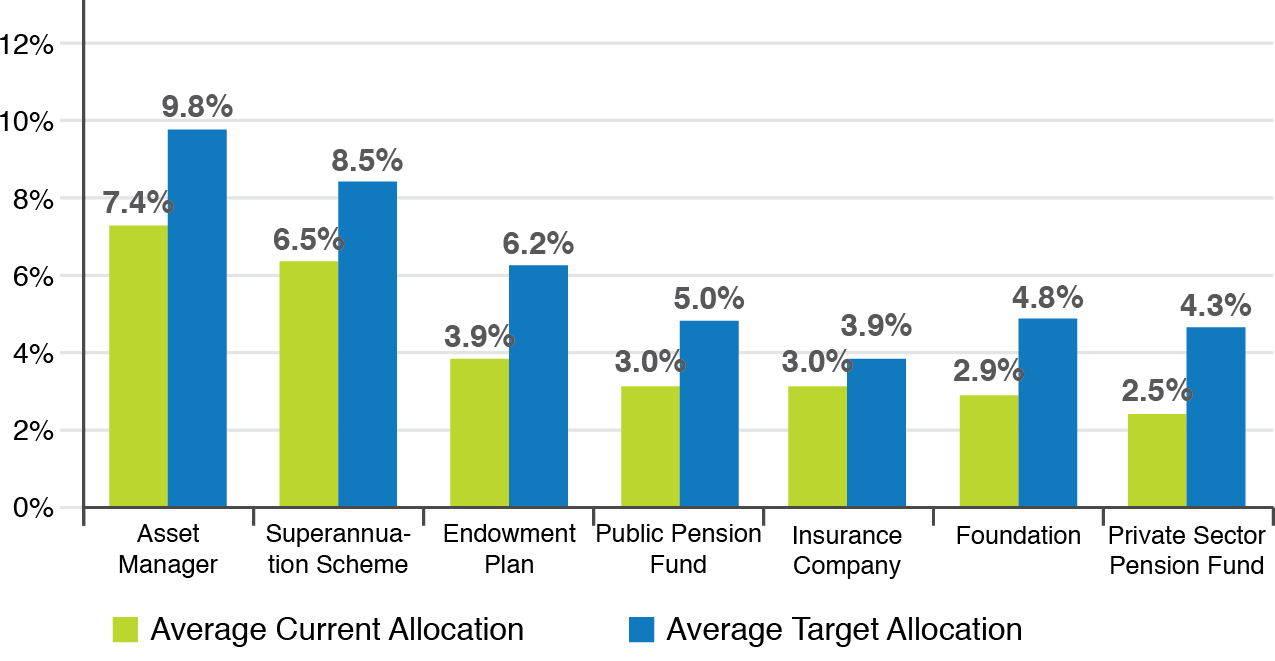

Pension Plan Investing

Average Allocation to Infrastructure as a Proportion of AUM - Estimate as at October 2016

*Source: Pension Investment Association of Canada, Asset Mix of DB Plans of Sponsor Organizations Represented by Members as at Dec 31, 2018.

Starlight Capital Approach

Despite this expansion in the definition of infrastructure there are still some risk exposures we choose to avoid. Pure services or constructions firms do not interest us. These firms often lack the long term cash flow visibility and true hard asset backstop that we seek from our infrastructure investments. This holds true for businesses with power or commodity price risk. Many of these firms must compete on price or are price-takers, which erodes any competitive advantage they may possess.

At Starlight we attempt to add value by concentrating our investments into high quality infrastructure businesses with strong value creation potential. Purchased when they offer enough return potential for the risk they expose us to these portfolios should deliver strong risk-adjusted returns to investors over the long-term.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing.

Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.