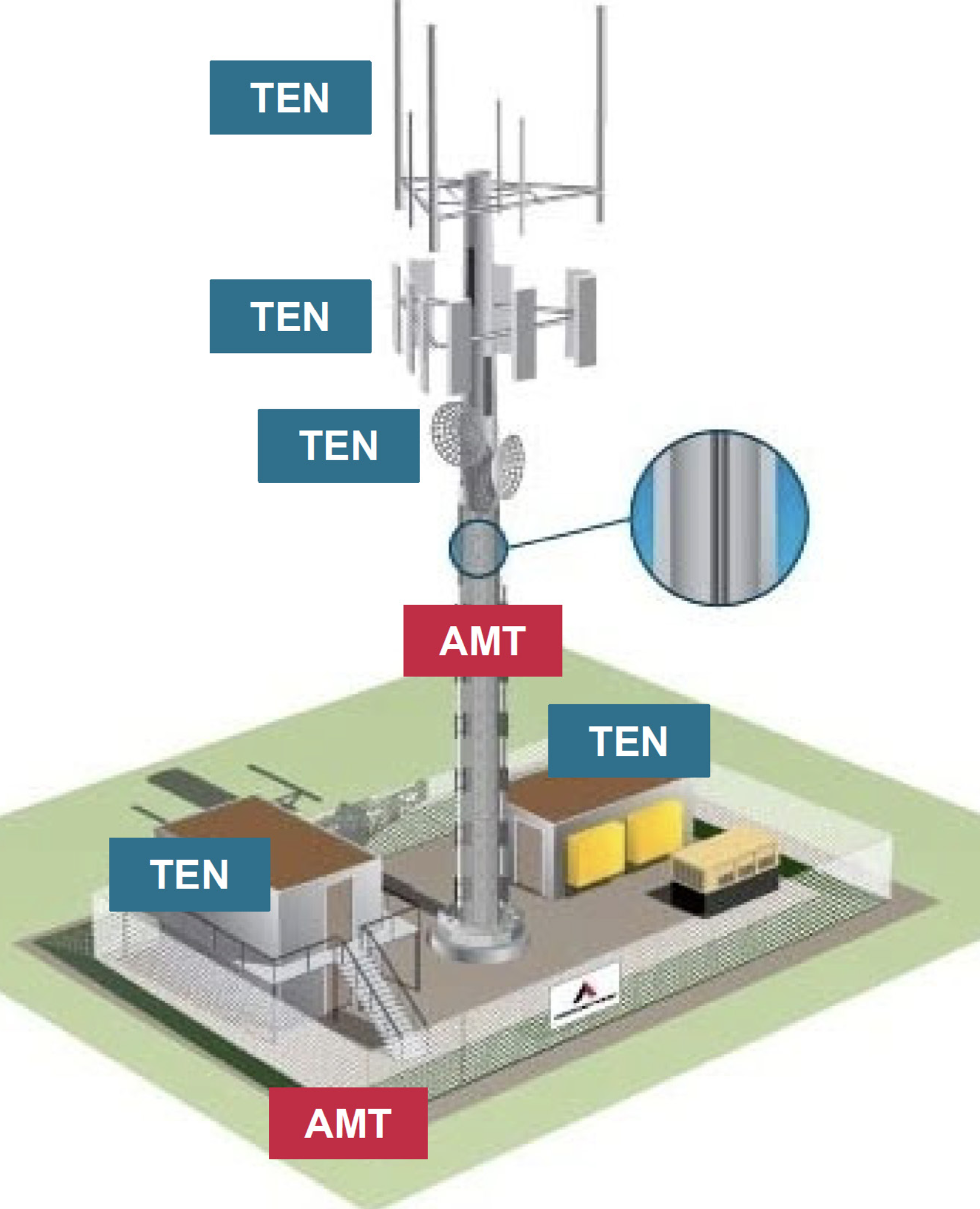

Tower REITS Drive Margins and Return on Capital

Operated by Tenant (AMT)

- Tower structure – our tower sites are typically constructed with the capacity to support ~4 - 5 tenants

- Land parcel owned or operated pursuant to a long-term lease by American Tower

- American Tower owns generators at some sites to help facilitate back-up power for the site’s tenants

Operated by American Tower (TEN)

- Antenna equipment, including microwave equipment

- Tenant shelters containing base station equipment and HVAC, which tenants own, operate and maintain

- Coaxial cable

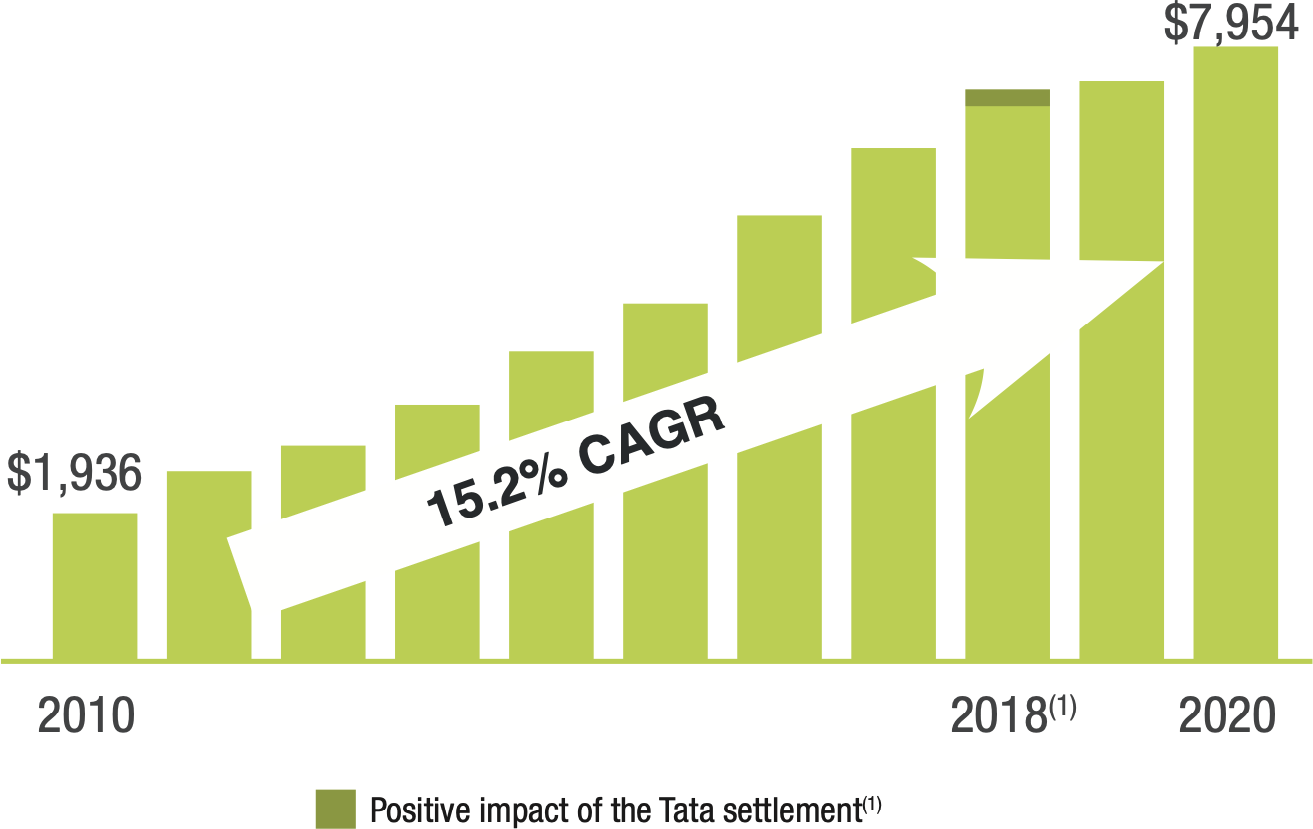

($ in Millions)

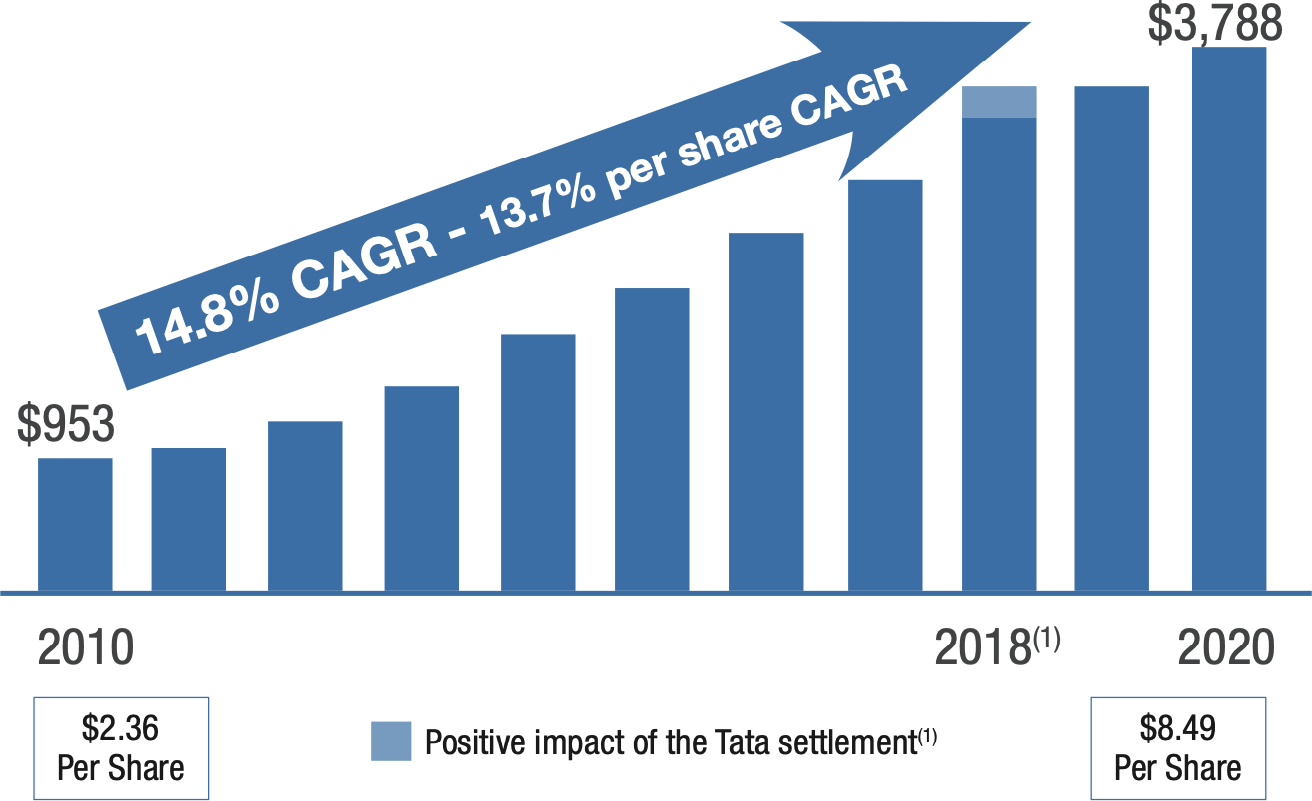

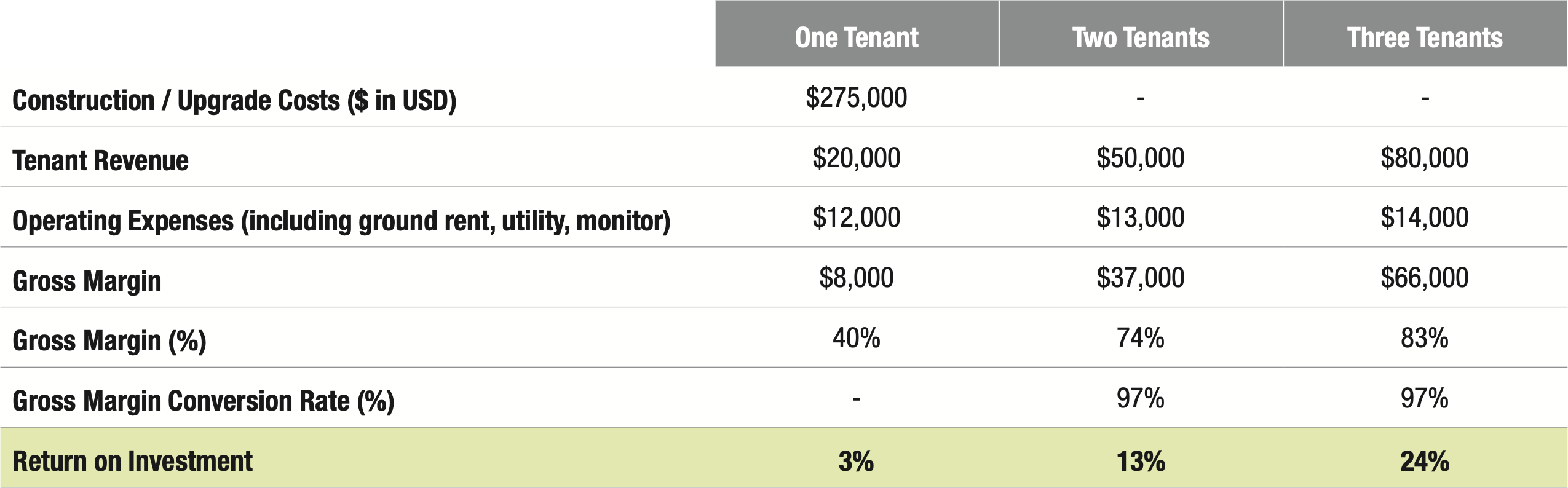

American Tower operates a global portfolio of over 170,000 communications sites in over 15 countries. In the US, American Tower’s tenants enter into five to 10-year leases with annual 3% escalators. Return on Investment is tied to tenant concentration and rises from 3% for one tenant to 13% for two tenants to 24% for three tenants, with Gross Margins rising similarly from 40% to 74% to 83%.

($ in Millions)

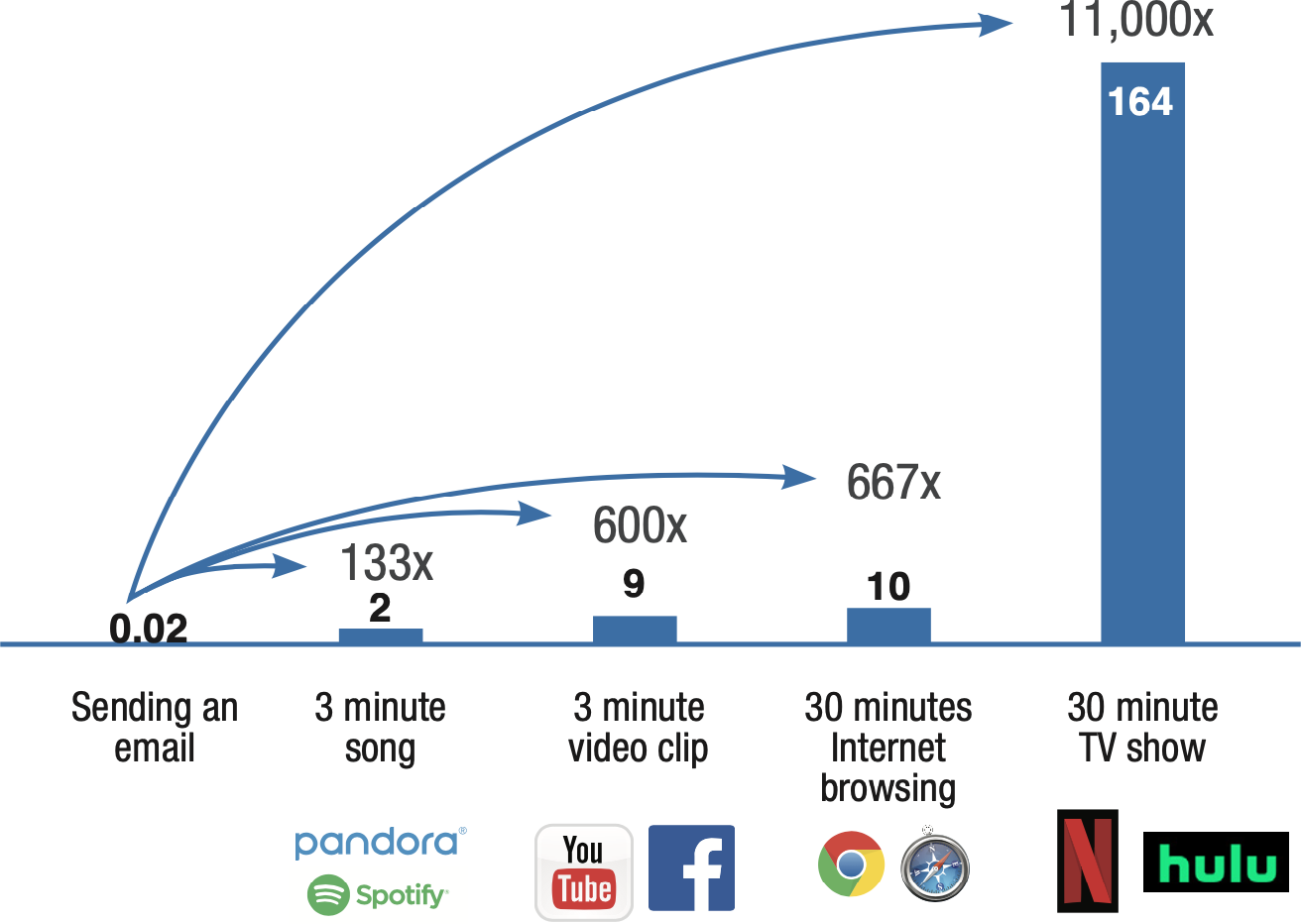

(in megabytes)

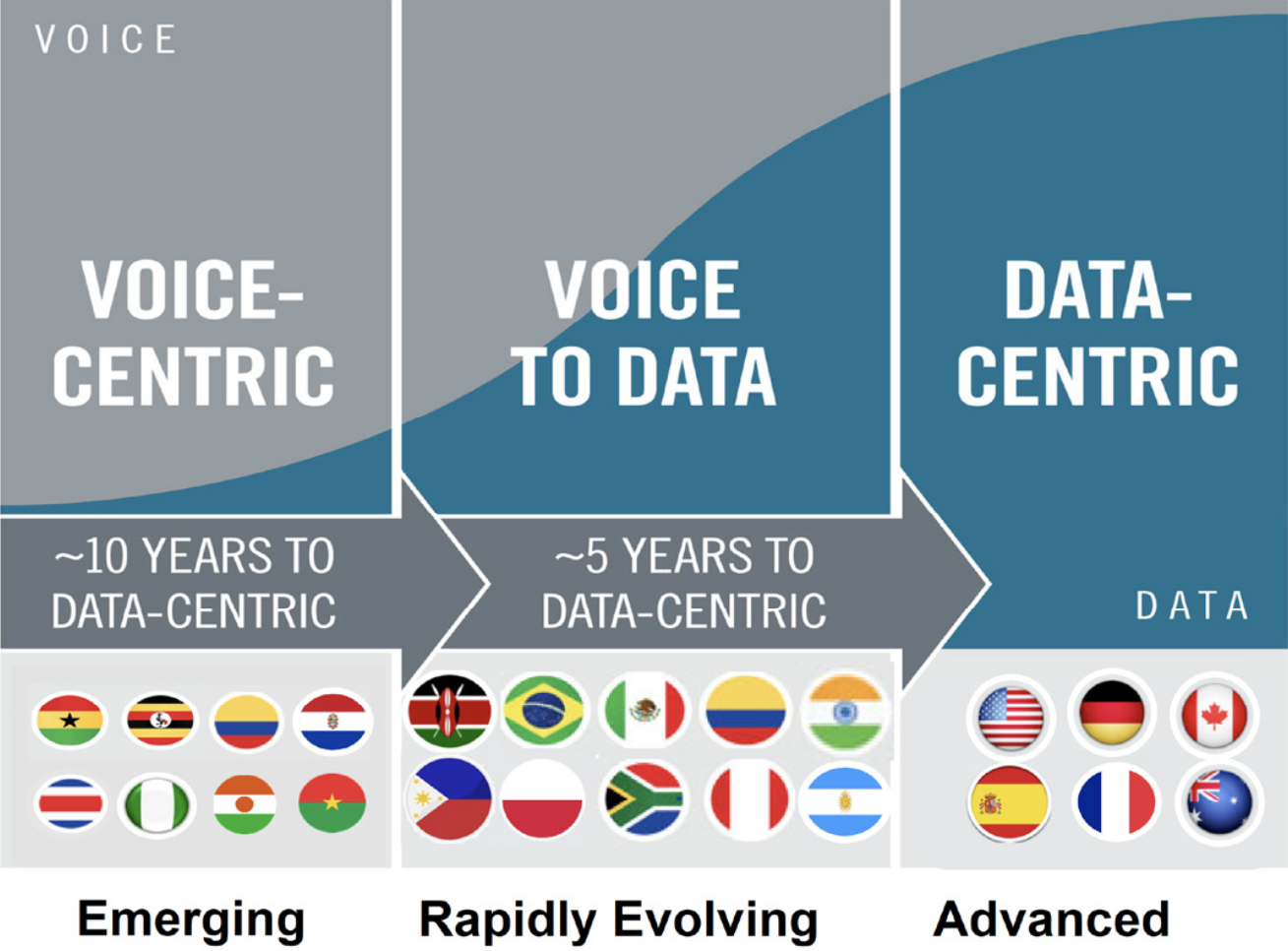

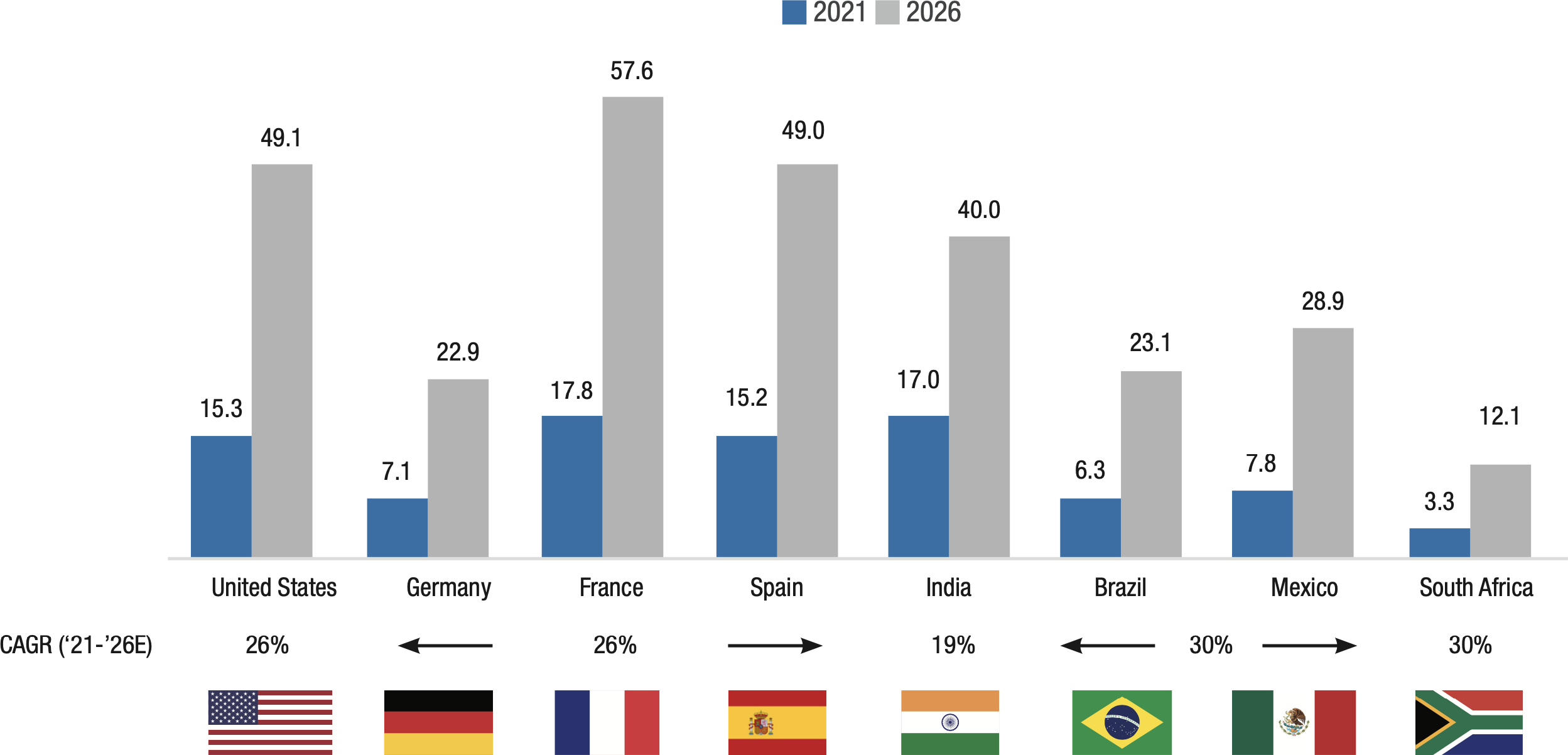

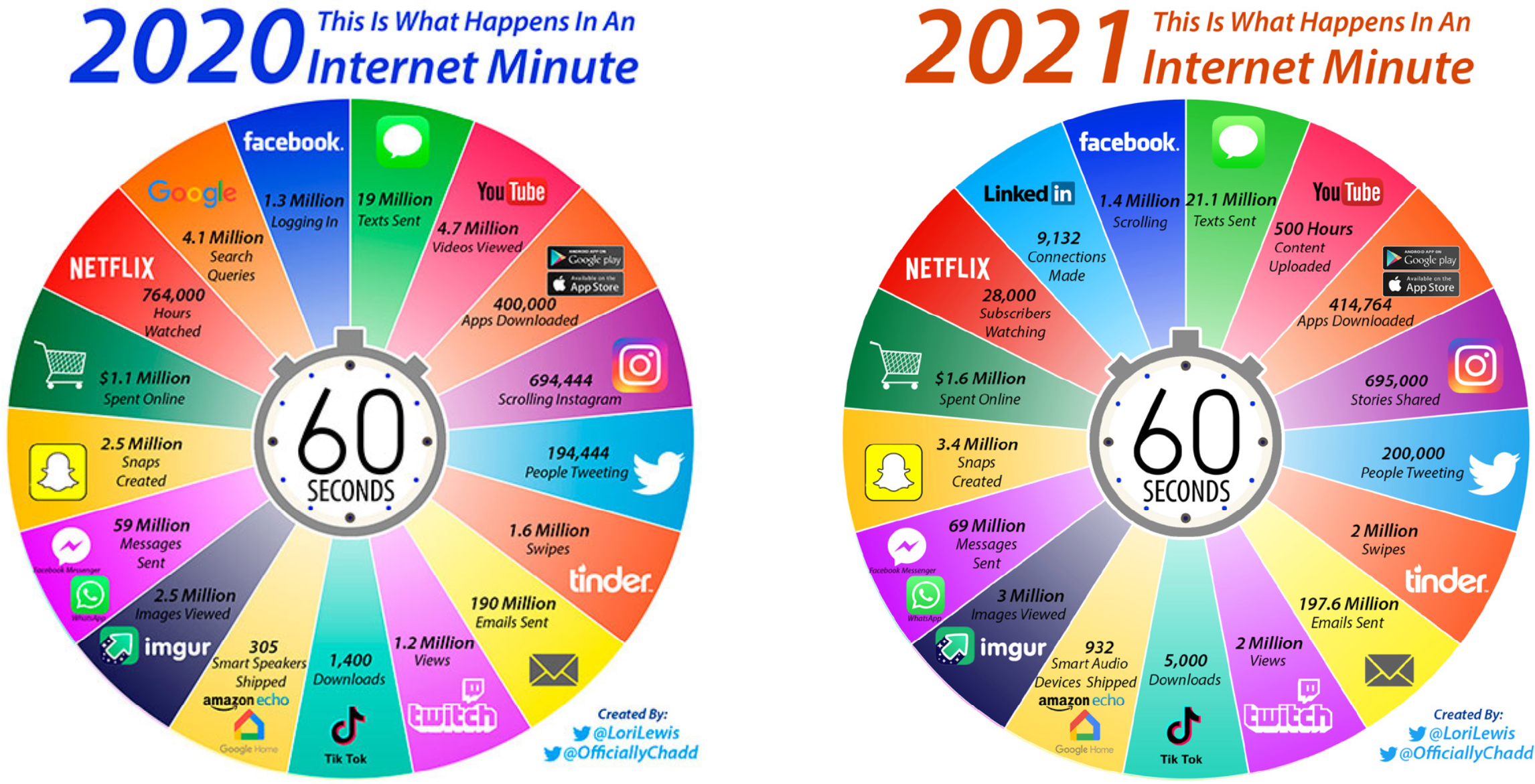

While the U.S. market is a mature smartphone market it still offers tremendous growth potential as data usage continues to grow. Other developing markets such as India, Brazil and South Africa represent even greater growth potential as their populations continue to grow while smartphone penetration and data usage also grow.

(in gigabytes)

Once the cell tower has two or three tenants it can be sold for a multiple of its cash flows (“Adjusted Funds From Operations” or “AFFO”). In the current market, U.S. cell towers are being acquired for 30x to 34x cash flow while U.S. cell tower REITs (American Tower Corporation, Crown Castle International Corp., SBA Communications Corp.) trade between 25x to 35x AFFO.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.