Traffic and Toll Growth Drive Toll Road Appreciation

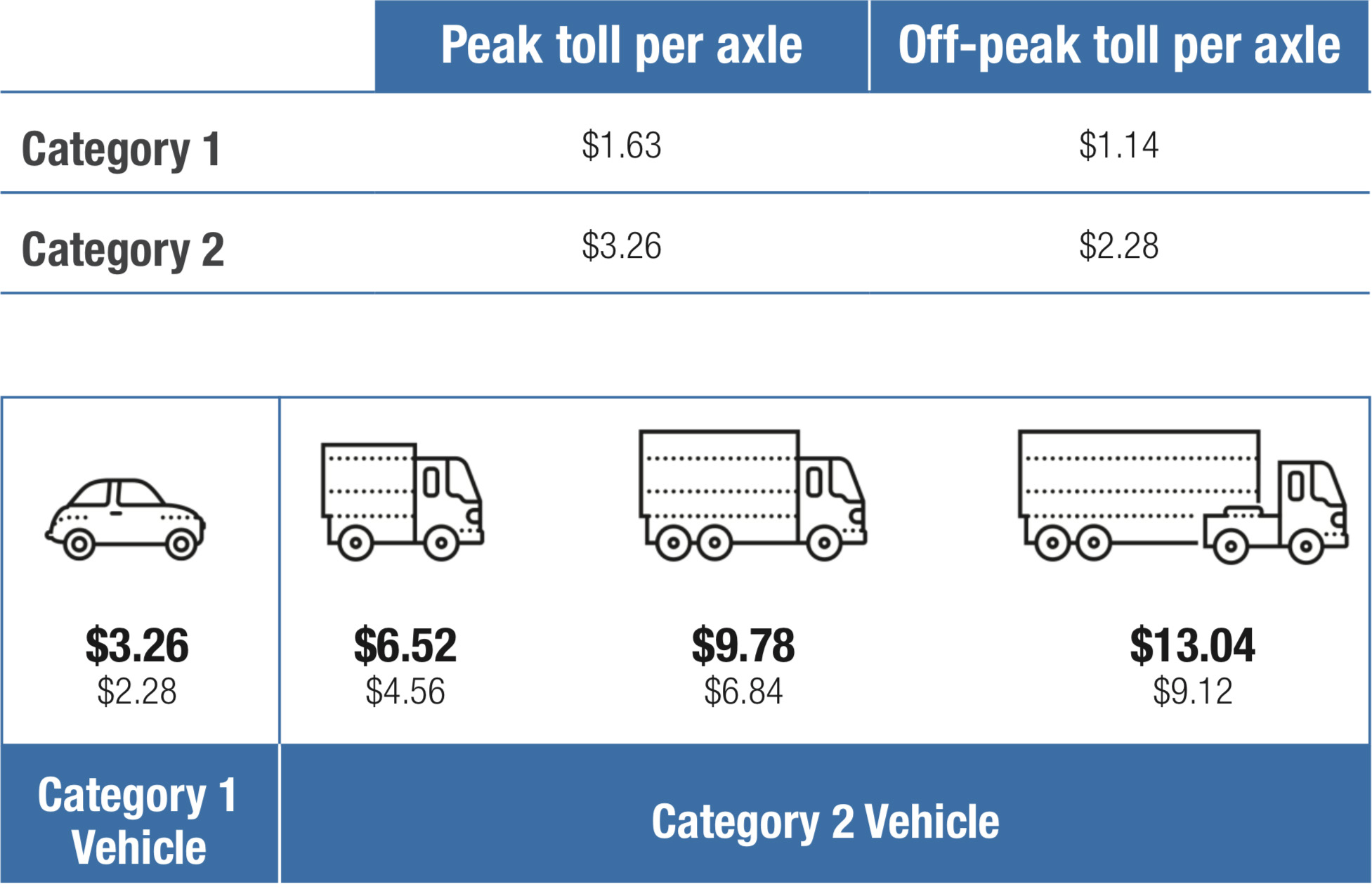

a toll is applied to generate revenue for the toll road operator. Light and heavy commercial vehicles (larger and/or more axles than a car) are charged a premium toll over the standard car toll to account for the heavier and commercial utilization of the toll road. Tolls are generally increased quarterly or annually, usually by a function of inflation with a minimum annual increase.

Current toll rates1

Source: Transurban Group, Investor Day 2018

Toll roads are usually constructed by the firm that wins the right to operate the concession (or their construction partner in the bid) so the municipality benefits from the private funding of a large infrastructure project which reduces commute times and drives productivity gains. Depending on the concession contract, the municipality may also share in the revenue the toll road generates. Toll road operators may invest in the toll road to widen or lengthen it. Such investments are rewarded by extending the length of the concession so that the toll road operator earns a return on the additional capital invested.

Toll roads are economically-sensitive assets as tolls and traffic volumes generally rise with increased economic output (higher inflation, more people working and commuting, more commercial vehicle traffic). However, toll roads generally provide greater than anticipated downside protection during weak economic periods since tolls generally still rise (minimum annual toll increases), population growth and household formation may still be positive and commuter traffic habits show signs of inertia.

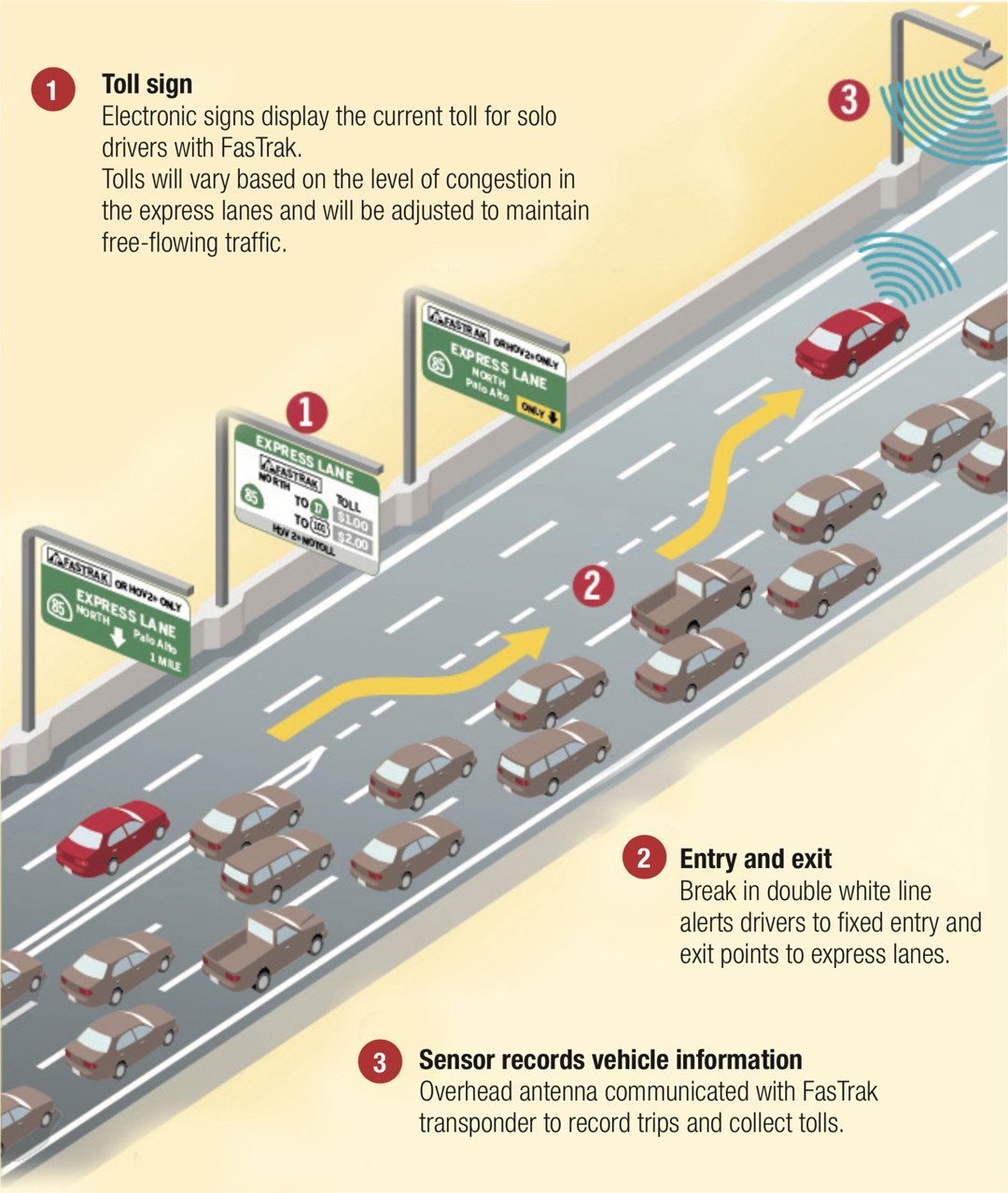

How express lanes work

Managed lanes are like toll roads except their primary purpose is to maintain a minimum speed in the lane over the course of the day. As traffic builds on a regular road, commuters may elect to move into the managed lanes to expedite their trip. The managed lanes charge commuters a variable toll that changes as frequently as every 5 minutes. As traffic in the managed lanes rises so does the toll to ensure that a minimum speed is maintained in the managed lane.

Ferrovial SA, through its subsidiary Cintra SA, is one of the leading private developers of transport infrastructure in the world in terms of number of projects and investment volume. Cintra manages 26 toll road and managed lane concessions extending over 2,072 kilometres in Canada, the U.S., Spain, the U.K., Portugal, Ireland, Greece, Slovakia, Colombia and Australia.

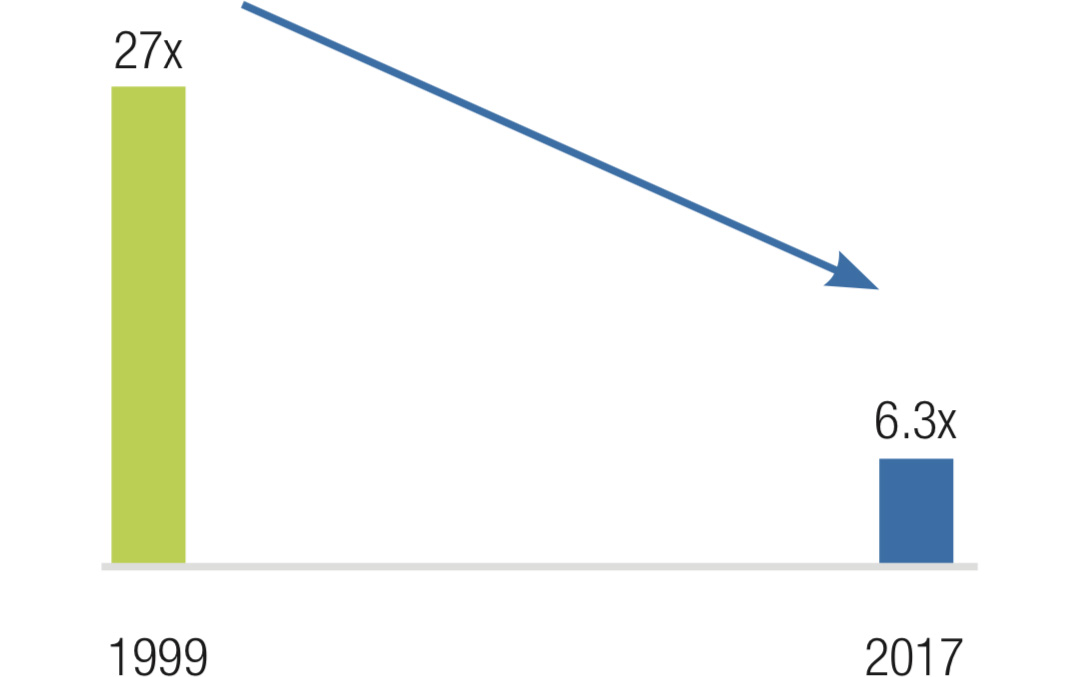

Cintra owns a 43.2% stake in the 407 ETR in Toronto and is the managing partner in the ownership group (along with SNC-Lavalin Group Inc., 16.8% and CPP Investment Board, 40.0%). This asset was initially purchased in 1999 for $3.1B and Cintra estimates that the value of the 407 has appreciated 35x since the initial purchase. Given that EBITDA generated by the 407 has grown to $1.3B this estimate may prove conservative, especially with 80 years left on the concession.

Unique assets in the infrastructure world

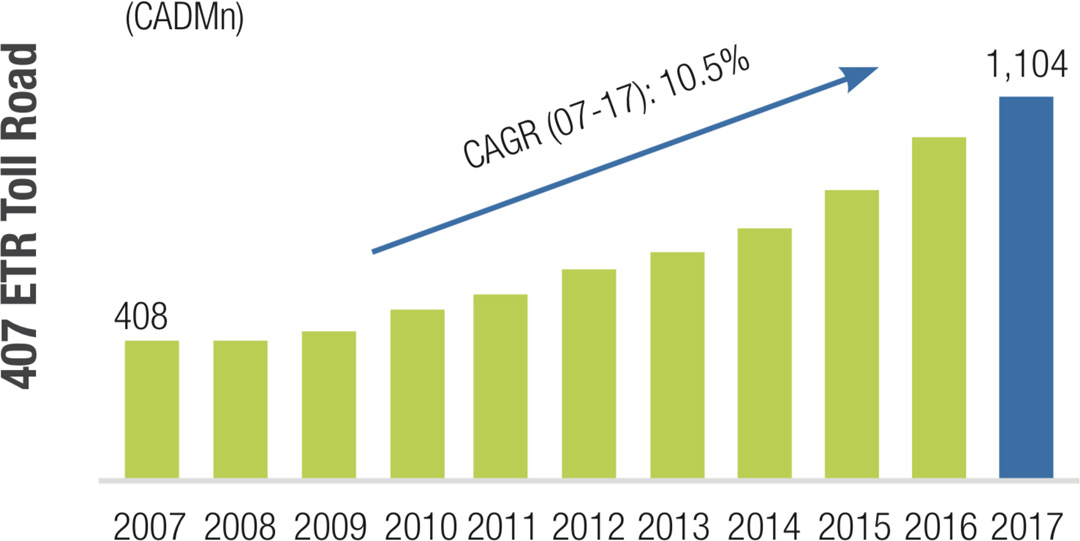

- Tariffs 2007-17 CAGR +9%

- EBITDA 2007-17 CAGR +10.5%

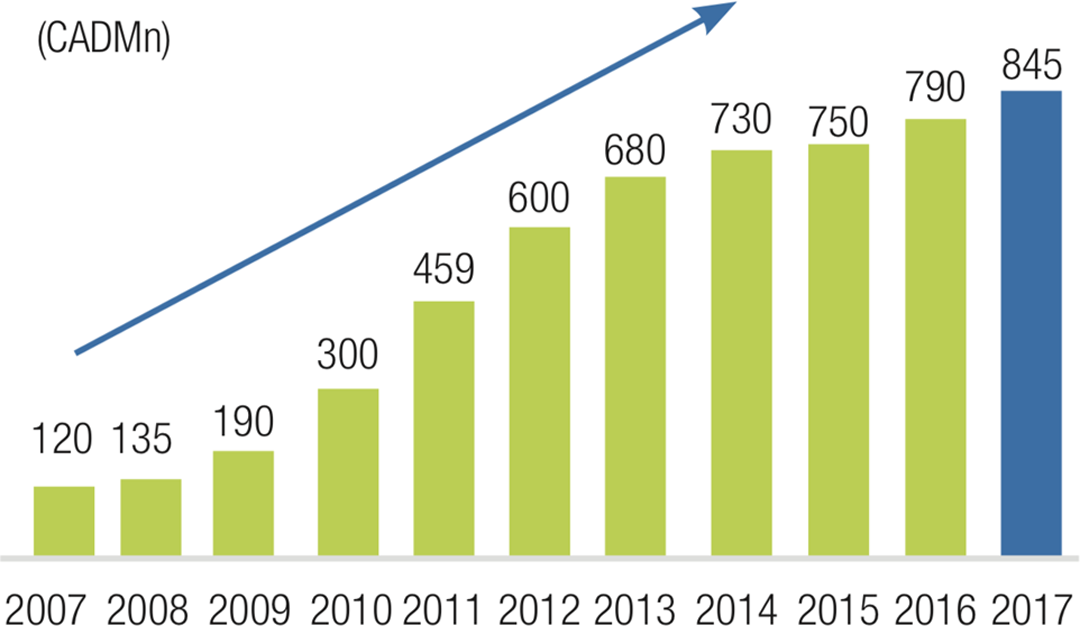

- Dividends CAD85mn’05 to CAD840mn 2017

- 100% payback First 10Y

- Valuation up 35x since ‘99

- 108kms in Greater Toronto

- Tariff freedom

- Tariff flexibility by segment, direction, time, day

- 80 years to maturity (to 2098)

- Alternative routes are strongly congested

- Fast & reliable travel times

- Free flow, electronic system

- Strong collection security

407 ETR, Toronto, Ontario (Canada): 43.2% stake (equity accounted)

EBITDA

Net Debt/EBITDA

Dividends

Source: Ferrovial, FY 2017

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Starlight, Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.