Starlight Private Global Infrastructure Pool 2024 Update

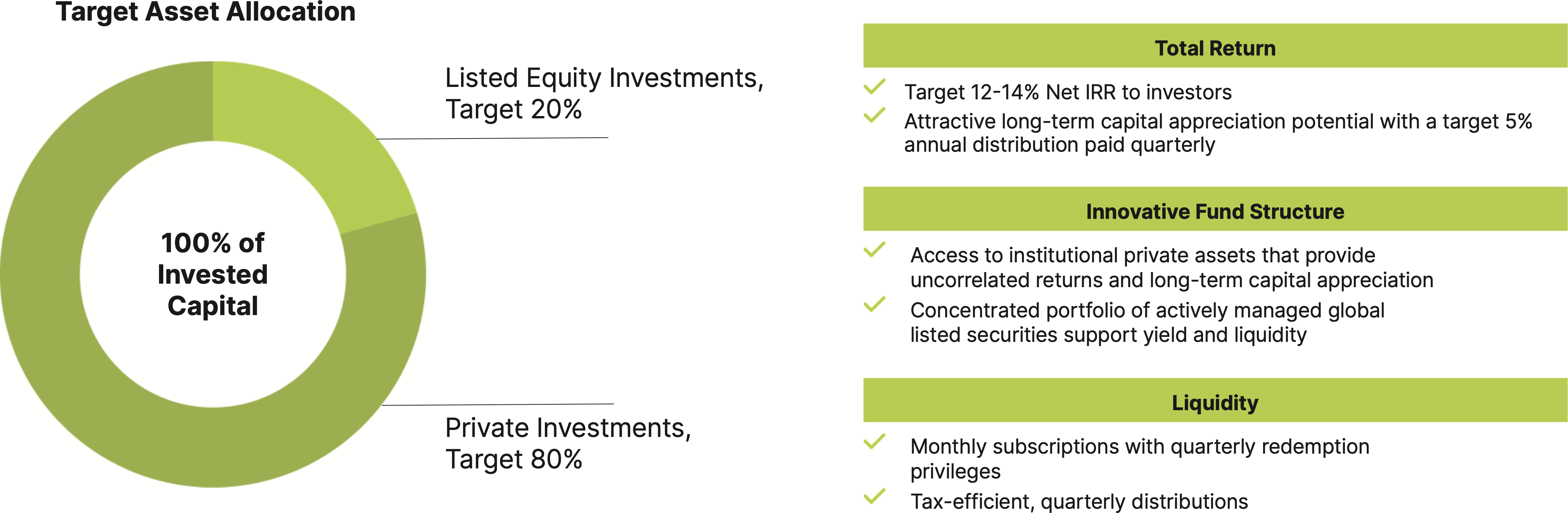

The Starlight Private Global Infrastructure Pool is designed to provide accredited investors with access to institutional-quality, private assets in a solution that provides both liquidity and income. The unique design (target 80% private asset funds, target 20% public listed securities) allows investors to partner with best-in-class, global institutional managers of private assets and invest alongside some of the largest pension funds, insurance companies and wealth managers in the world.

2024 Year to Date

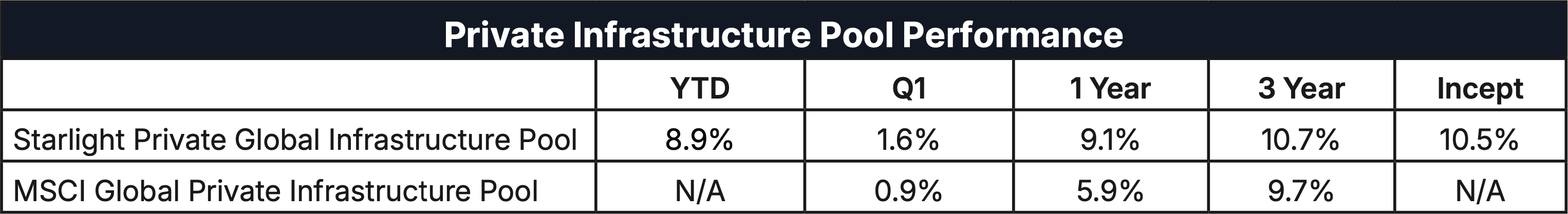

The Starlight Private Global Infrastructure Pool (“Pool”) has generated a 8.9% total return year to date. The Pool’s current annual yield (paid quarterly) is 5.4% and in 2023 the distribution was 100% return of capital for tax purposes.

Through the end of July, the listed securities portfolio delivered a 5.2% total return while generating 8 dividend and distribution increases with an average increase of 7.8%. Declining interest rates in both Canada and the United States have pushed discount rates and cap rates down, positively impacting the valuation of the private assets.

The returns of the Starlight Private Global Infrastructure Pool compare very favourably to the universe of private infrastructure solutions.

Through the end of July, the listed securities portfolio delivered a 5.2% total return while generating 8 dividend and distribution increases with an average increase of 7.8%. Declining interest rates in both Canada and the United States have pushed discount rates and cap rates down, positively impacting the valuation of the private assets.

The returns of the Starlight Private Global Infrastructure Pool compare very favourably to the universe of private infrastructure solutions.

Exhibit 1 - Starlight Private Global Infrastructure Pool Performance

Source: Starlight Capital, MSCI Burgiss as of July 31, 2024. Inception date is April 2020 for Series F of the Starlight Private Global Infrastructure Pool.

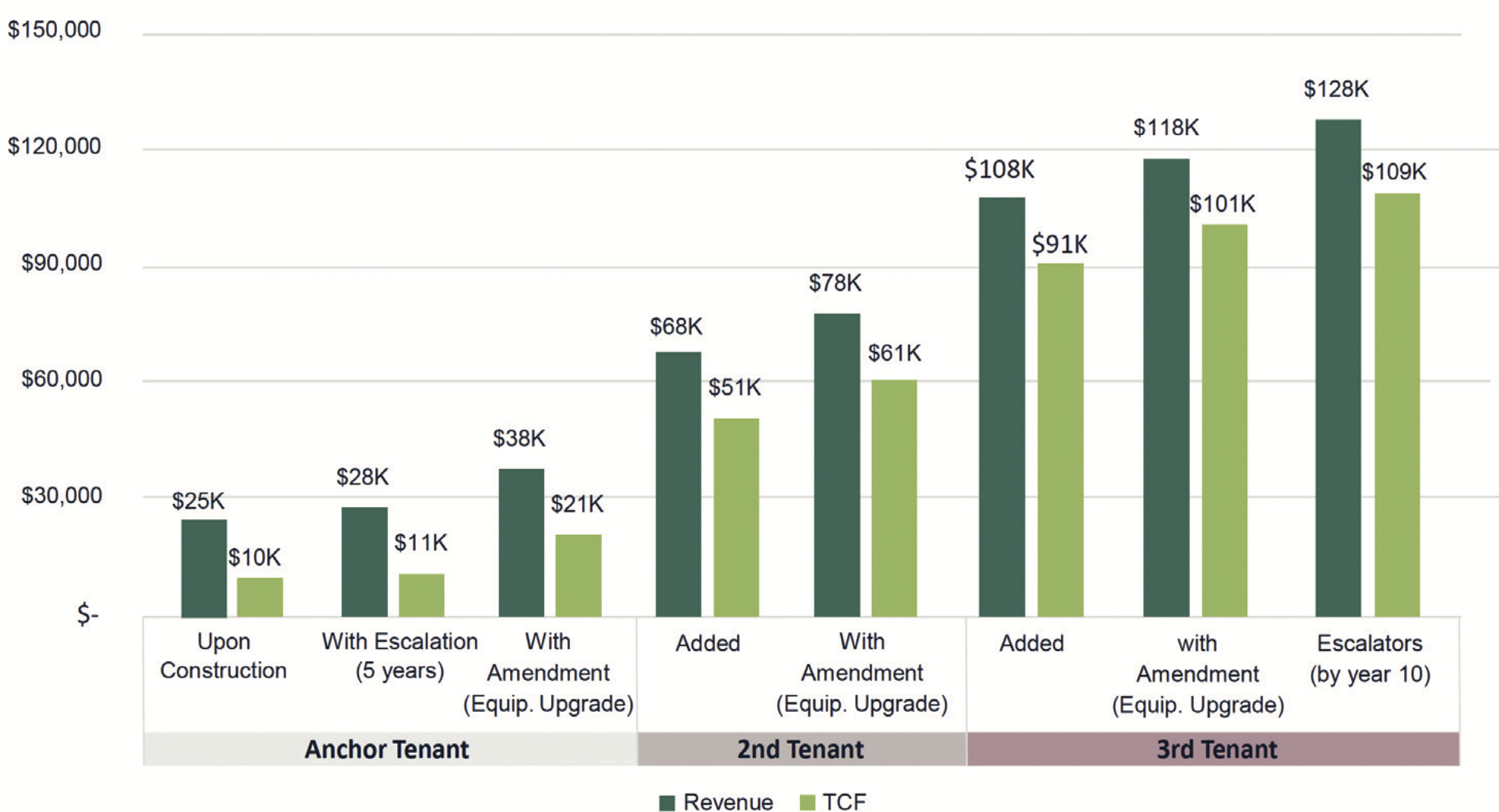

Peppertree Capital Fund IX

Peppertree Capital is the dominant developer of cell towers in the United States. Towers are developed, leased up to telecom firms (i.e. Verizon, AT&T and T-Mobile) and sold to tower aggregators (i.e. American Tower, Crown Castle and SBA Communications). Historically Peppertree has generated a 1.89x net return on invested capital and a 16.6% net IRR.

Peppertree Capital is the dominant developer of cell towers in the United States. Towers are developed, leased up to telecom firms (i.e. Verizon, AT&T and T-Mobile) and sold to tower aggregators (i.e. American Tower, Crown Castle and SBA Communications). Historically Peppertree has generated a 1.89x net return on invested capital and a 16.6% net IRR.

Exhibit 2 – Example of Modeled TCF Growth Over Extended Time Period

Source: Peppertree Capital as of July 31, 2024.

In 2024, Peppertree Capital Fund IX (“PCF IX”) has developed 297 towers, bringing the total towers constructed to 3,220. PCF IX currently has 1,224 cell towers under construction and 440 pending acquisition. Demand for new towers continues to be driven by population growth, connected device growth, data-intensive application development and network evolution (from 4G to 5G).

Going into 2025, we expect PCF IX to begin liquidating tower portfolios at 30x – 40x Tower Cash Flow or better. This would generate additional returns and liquidity for the Infrastructure Pool, allowing us to allocate to the next Peppertree fund or other investment opportunities that offer a 15%+ total return. PCF IX generated an approx. 21.7% total return in 2023 and we expect strong, total returns to continue in 2024, driven by additional tower development, annual contractual rent escalators, lease amendment rental gains and increased tenant intensity on existing towers.

IFM Global Infrastructure Fund

IFM Investors (“IFM”) is a US $148.0 billion global asset manager based in Australia and founded over 25 years ago by a conglomerate of pension funds. IFM manages US $75.0 billion of global Infrastructure assets, including the US $59.0 billion open-end, IFM Global Infrastructure Fund (“GIF”). GIF targets core infrastructure in developed markets and currently has interests in 23 infrastructure investments across the globe.

GIF should experience positive performance from its Toll Road, Airport, Utilities & Renewables and Digital assets, which represent 74.4% of the GIF portfolio. In contrast, economic weakness should weigh on the Seaport and Midstream assets, which represent 25.7% of the GIF portfolio. GIF’s weighted average leverage continues to decline and sits at 33.8% with a weighted average debt maturity of 8.6 years. We have sold our position in GIF and have redeployed the capital into listed securities at a material discount to Net Asset Value and other private investments.

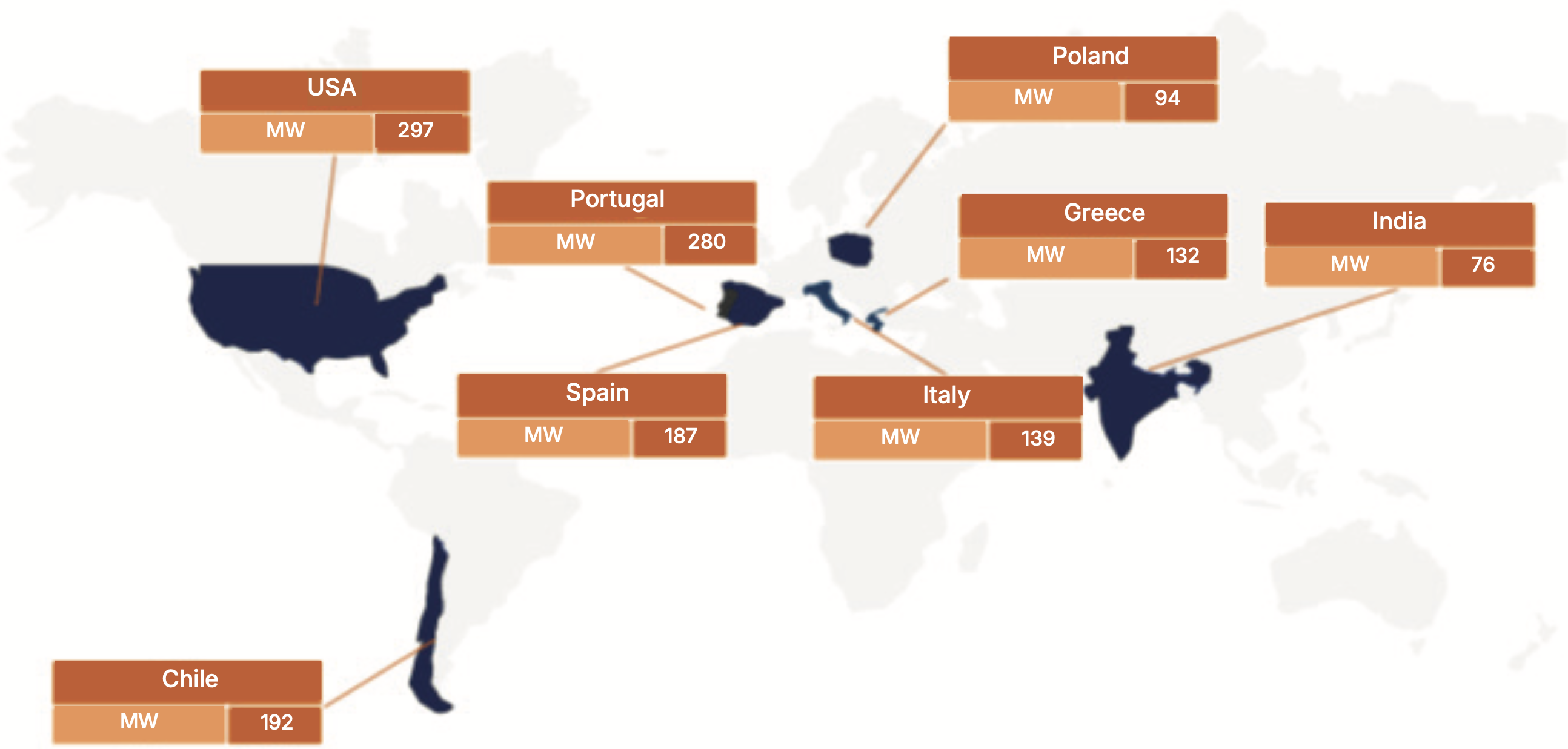

NextPower Capital Fund III

NextEnergy Group (“NextEnergy”) was founded in 2007 and is a leading developer, owner and manager of utility-scale, global solar PV energy assets. NextEnergy has US $3.9 billion of assets under management invested in 407 solar plants comprising 1,542 MW of production capacity in operation and 1,056 MW of production capacit under development. NextEnergy’s strategy is twofold – acquire existing assets and optimize their performance and win Request for Proposals (“RFPs”) to win the right to develop new solar assets. Historically, NextEnergy has generated Net IRR’s of 15.3% and 25.5% in the NextPower Capital series of funds.

NextPower III ESG Fund (“NPIII”) has been heavily focused on investment, both through acquisitions and development. In 2023, NPIII added 178 MW of solar capacity across Italy and Poland in three M&A transactions. This brought NPIII’s capacity to 1.4 GW of solar capacity plus 400 MW of battery storage in Greece. The 1.4 GW of capacity generates enough electricity to power over 1 million homes for a year. NPIII currently has 800 MW of capacity in operations with the remaining 600 MW under construction. NPIII expects 200 MW of capacity to enter commercial operations (Chile, USA, Spain and Italy) in 2024 generating another significant uplift in valuations and total returns for the Pool. Since inception, NPIII has generated a 1.3x Gross MOIC and a Gross IRR of 13.5%.

Going into 2025, we expect PCF IX to begin liquidating tower portfolios at 30x – 40x Tower Cash Flow or better. This would generate additional returns and liquidity for the Infrastructure Pool, allowing us to allocate to the next Peppertree fund or other investment opportunities that offer a 15%+ total return. PCF IX generated an approx. 21.7% total return in 2023 and we expect strong, total returns to continue in 2024, driven by additional tower development, annual contractual rent escalators, lease amendment rental gains and increased tenant intensity on existing towers.

IFM Global Infrastructure Fund

IFM Investors (“IFM”) is a US $148.0 billion global asset manager based in Australia and founded over 25 years ago by a conglomerate of pension funds. IFM manages US $75.0 billion of global Infrastructure assets, including the US $59.0 billion open-end, IFM Global Infrastructure Fund (“GIF”). GIF targets core infrastructure in developed markets and currently has interests in 23 infrastructure investments across the globe.

GIF should experience positive performance from its Toll Road, Airport, Utilities & Renewables and Digital assets, which represent 74.4% of the GIF portfolio. In contrast, economic weakness should weigh on the Seaport and Midstream assets, which represent 25.7% of the GIF portfolio. GIF’s weighted average leverage continues to decline and sits at 33.8% with a weighted average debt maturity of 8.6 years. We have sold our position in GIF and have redeployed the capital into listed securities at a material discount to Net Asset Value and other private investments.

NextPower Capital Fund III

NextEnergy Group (“NextEnergy”) was founded in 2007 and is a leading developer, owner and manager of utility-scale, global solar PV energy assets. NextEnergy has US $3.9 billion of assets under management invested in 407 solar plants comprising 1,542 MW of production capacity in operation and 1,056 MW of production capacit under development. NextEnergy’s strategy is twofold – acquire existing assets and optimize their performance and win Request for Proposals (“RFPs”) to win the right to develop new solar assets. Historically, NextEnergy has generated Net IRR’s of 15.3% and 25.5% in the NextPower Capital series of funds.

NextPower III ESG Fund (“NPIII”) has been heavily focused on investment, both through acquisitions and development. In 2023, NPIII added 178 MW of solar capacity across Italy and Poland in three M&A transactions. This brought NPIII’s capacity to 1.4 GW of solar capacity plus 400 MW of battery storage in Greece. The 1.4 GW of capacity generates enough electricity to power over 1 million homes for a year. NPIII currently has 800 MW of capacity in operations with the remaining 600 MW under construction. NPIII expects 200 MW of capacity to enter commercial operations (Chile, USA, Spain and Italy) in 2024 generating another significant uplift in valuations and total returns for the Pool. Since inception, NPIII has generated a 1.3x Gross MOIC and a Gross IRR of 13.5%.

Exhibit 3 - NextPower III ESG Fund Portfolio

Source: NextEnergy Group as of July 31, 2024.

NPIII does not have debt at the fund level, preferring to have construction financing or amortizing, long term debt as the project level. NPIII refinanced assets in Portugal and Chile in 2023 to generate cash and will look to refinance assets in Poland and Spain in 2024. NPIII is capped at 55% leverage to gross asset value and currently sits at 24%, providing access to US $227 million of additional debt. Approximately 75% of the current leverage is either hedged or fixed rate debt. The anticipated global rate cut cycle would be a positive for NPIII as discount rates and IRRs would come down, enhancing asset valuations and potential sale prices of assets.

Power price curves spiked in Europe after the Russian invasion of Ukraine. They remain elevated above their pre-invasion levels but off their two-year highs. European gas prices and new energy supply (especially new solar) will be the marginal drivers of solar pricing in 2024. NPIII benefited from in-house construction and procurement teams and capex costs declined in 2023 as pricing was negotiated with Chinese suppliers in 2022.

In Q4 of 2023, NPIII experienced an approx. 14.9% valuation uplift from 178 MW of assets moving from the construction phase into commercial operations. We expect NPIII to generate similar capital appreciation in Q4 of 2024 as they are scheduled to move 200MW of assets from the construction phase into commercial operations. NPIII will also commence cash distributions to the Pool in the second half of 2024 from the refinancing of assets that have completed the optimization process and from the refinancing of assets entering commercial service.

NextPower management has guided towards 10%+ total returns in 2024 and we expect the performance to continue in 2025 as NPIII continues to bring more assets into operations with additional upside potential as they begin to sell assets.

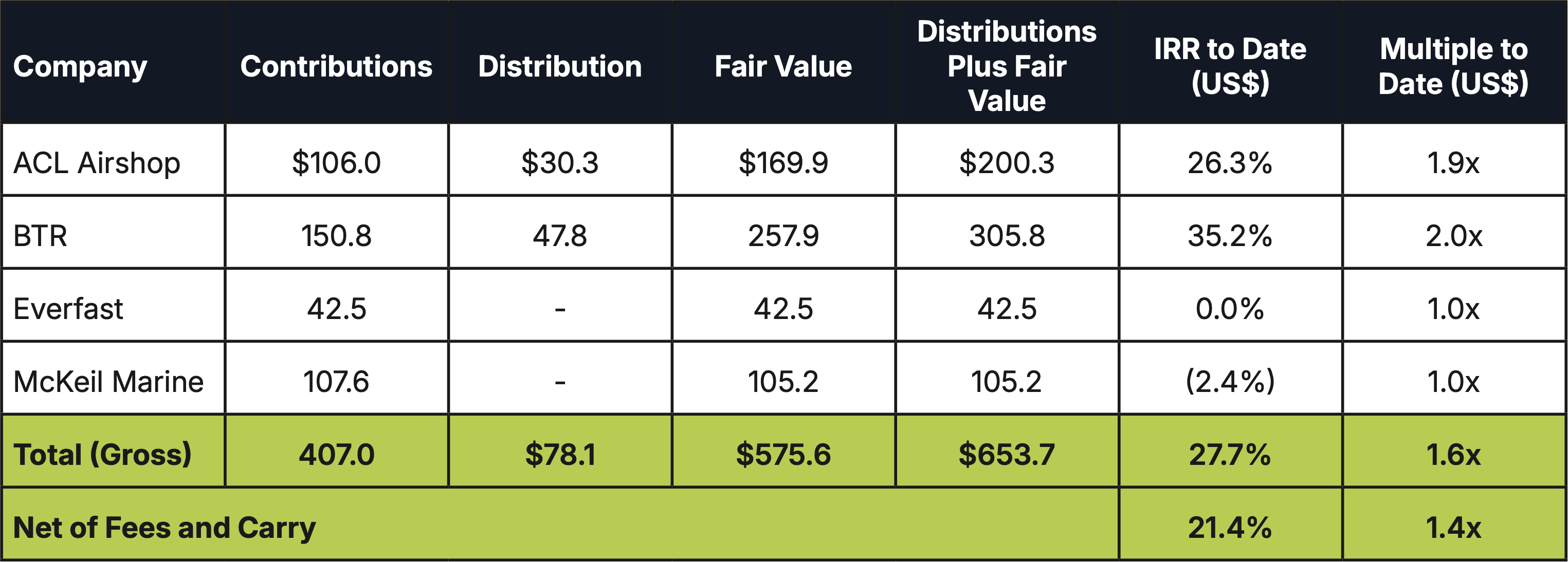

Alinda Capital Fund IV

Alinda Capital Partners has re-branded to Astatine Investment Partners (“Astatine”) but remains focused on mid-market private equity investments in the Utility, Transportation and Digital sectors of Infrastructure. Astatine’s strategy is to focus on quality businesses in industries that are seeing growth and have the potential for consolidation. Astatine then takes a majority position in target companies and invests to increase capacity and consolidate smaller competitors. Over 10+ years, Astatine has allocated $13 billion and Alinda Capital Fund III generated a 15.0% Gross IRR and 1.8x Gross MOIC.

In 2023 Astatine focused on integrating their recent acquisitions of Everfast Fiber Networks and McKeil Marine. Both are held at cost and should begin to experience positive valuation lifts late in 2024. Astatine’s best performing asset has been BTR, a US-based waste collection business with 1,100 waste collection trucks and tractors. BTR has generated a 35.2% Gross IRR and a 2.0x Gross MOIC, including $47.8 million in distributions from a $150.8 million investment. Astatine refinanced BTR to fund the acquisition of the UK waste collection business NRG Riverside. NRG Riverside operates a fleet of 2,000 refuse collection vehicles, up 25% in the last two years, and currently generates a 55.0% EBITDA margin. NRG Riverside was underwritten at a 15.0% Gross IRR, including a 10.0% cash yield, and a 2.0x Gross MOIC.

Power price curves spiked in Europe after the Russian invasion of Ukraine. They remain elevated above their pre-invasion levels but off their two-year highs. European gas prices and new energy supply (especially new solar) will be the marginal drivers of solar pricing in 2024. NPIII benefited from in-house construction and procurement teams and capex costs declined in 2023 as pricing was negotiated with Chinese suppliers in 2022.

In Q4 of 2023, NPIII experienced an approx. 14.9% valuation uplift from 178 MW of assets moving from the construction phase into commercial operations. We expect NPIII to generate similar capital appreciation in Q4 of 2024 as they are scheduled to move 200MW of assets from the construction phase into commercial operations. NPIII will also commence cash distributions to the Pool in the second half of 2024 from the refinancing of assets that have completed the optimization process and from the refinancing of assets entering commercial service.

NextPower management has guided towards 10%+ total returns in 2024 and we expect the performance to continue in 2025 as NPIII continues to bring more assets into operations with additional upside potential as they begin to sell assets.

Alinda Capital Fund IV

Alinda Capital Partners has re-branded to Astatine Investment Partners (“Astatine”) but remains focused on mid-market private equity investments in the Utility, Transportation and Digital sectors of Infrastructure. Astatine’s strategy is to focus on quality businesses in industries that are seeing growth and have the potential for consolidation. Astatine then takes a majority position in target companies and invests to increase capacity and consolidate smaller competitors. Over 10+ years, Astatine has allocated $13 billion and Alinda Capital Fund III generated a 15.0% Gross IRR and 1.8x Gross MOIC.

In 2023 Astatine focused on integrating their recent acquisitions of Everfast Fiber Networks and McKeil Marine. Both are held at cost and should begin to experience positive valuation lifts late in 2024. Astatine’s best performing asset has been BTR, a US-based waste collection business with 1,100 waste collection trucks and tractors. BTR has generated a 35.2% Gross IRR and a 2.0x Gross MOIC, including $47.8 million in distributions from a $150.8 million investment. Astatine refinanced BTR to fund the acquisition of the UK waste collection business NRG Riverside. NRG Riverside operates a fleet of 2,000 refuse collection vehicles, up 25% in the last two years, and currently generates a 55.0% EBITDA margin. NRG Riverside was underwritten at a 15.0% Gross IRR, including a 10.0% cash yield, and a 2.0x Gross MOIC.

Exhibit 4 - Astatine Capital Fund IV Portfolio

Source: Astatine Investment Partners as of July 31, 2024

For 2024, Astatine management believes the current portfolio will generate 10.0%+ total returns in 2024. This is based on the initial valuation uplifts for Everfast and McKeil Marine as well as the continued strong performance of BTR and the initial performance of NRG Riverside. Rate cuts from the Federal Reserve Bank and the Bank of England should drive valuations up for most of Astatine’s assets. In addition, the performance of the two waste collection businesses should continue to be very robust, including cash distributions to the Pool.

2024 Performance Outlook

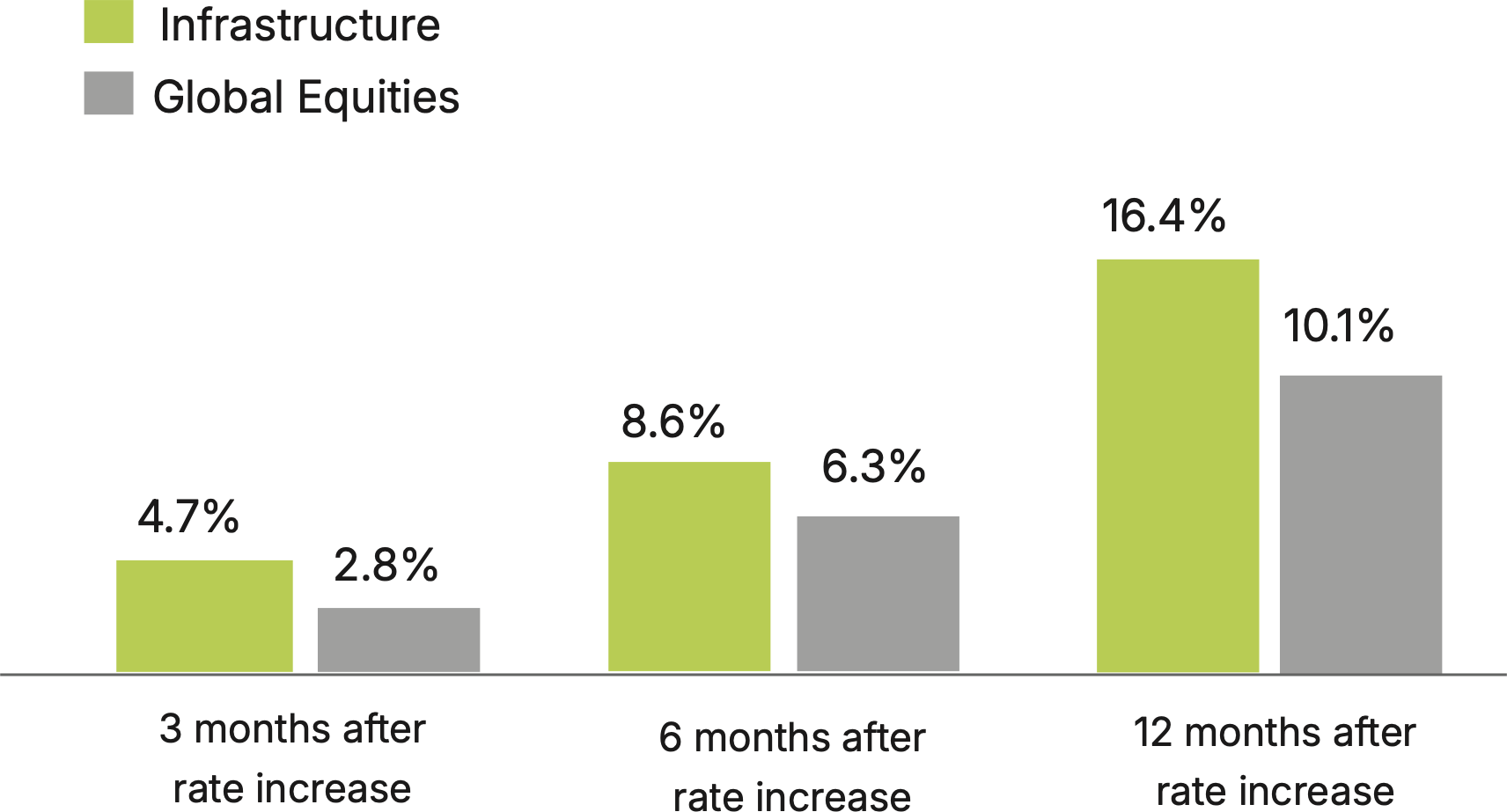

Much of the performance of global infrastructure in 2023 was driven by a global central bank hiking cycle from 2022 through 2023. This hiking cycle has ended, and the Bank of Canada has begun cutting the Overnight Rate. The Federal Reserve Bank has followed suit with a large 50 bps cut to the Federal Funds Rate in September.Historically publicly-traded infrastructure has outperformed after rate hike cycles end and also when long bond yields fall.

Exhibit 5 - Infrastructure Total Return After the End of Rate Hike Cycles

Source: Bloomberg, Morningstar, Cohen & Steers proprietary analysis. As of April 30, 2022.

The rate hike cycle did not significantly impact infrastructure earnings however, infrastructure trading multiples fell significantly. Many investors remain underweight infrastructure but as rates fall and infrastructure earnings rise, we expect infrastructure multiples will continue to expand.

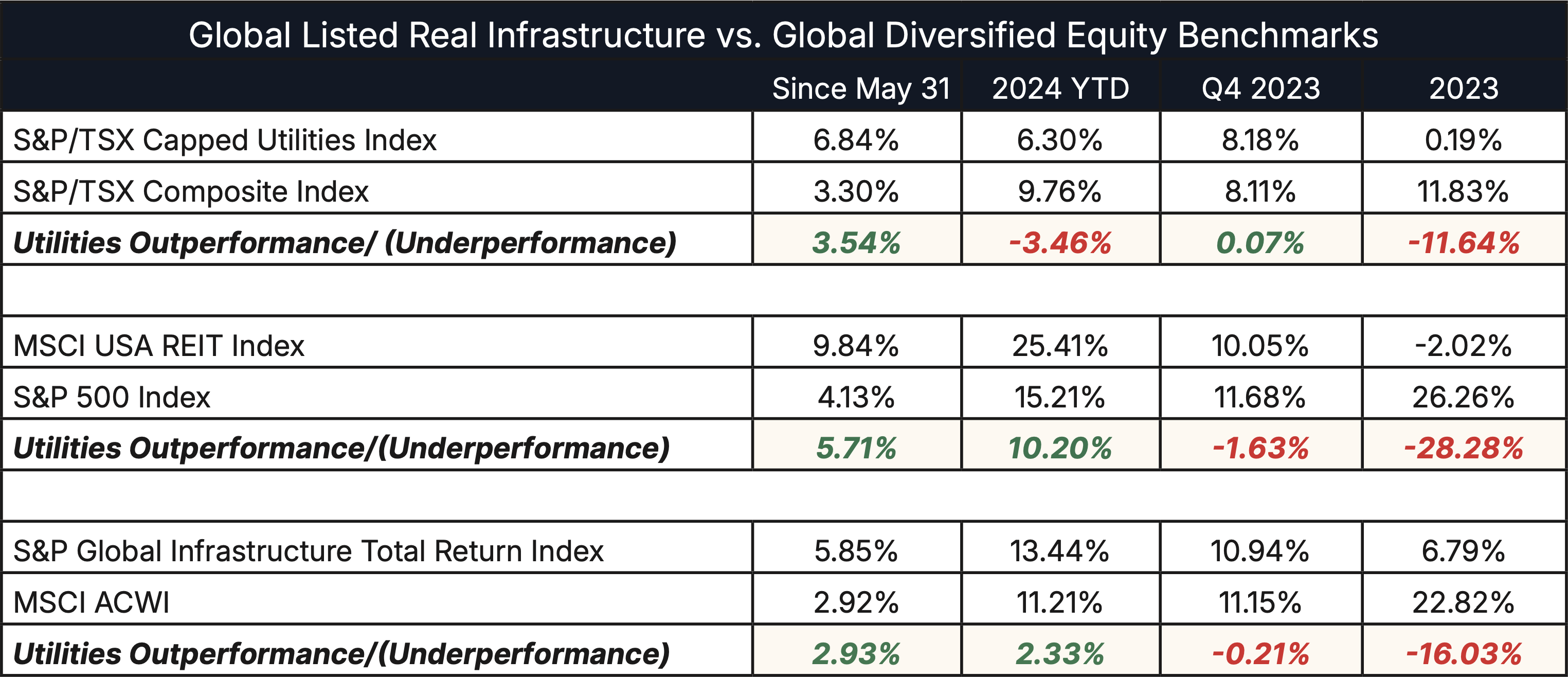

Exhibit 6 - Global Listed Infrastructure Performance vs. Global Diversified Equity Benchmarks

Source: Bloomberg Finance L.P. as of September 10, 2024.

Note: Canadian Securities in CAD, US securities in USD.

The Starlight Global Infrastructure Pool was designed to generate 12.0%-14.0% annual total returns to investors, including a 5.0% annual distribution yield. Since inception (April 30, 2020), the Pool has generated an annualized total return of 10.5% and initial investors have seen their annualized yield rise to 6.6%. We anticipate that the Infrastructure Pool will continue to generate strong positive returns in 2024 with additional upside in 2025 tied to the sale of solar assets and cell towers in our private investments.

We invite you to partner with us.

Starlight Private Global Infrastructure Pool

Starlight Private Global Infrastructure Pool

Innovative Fund Structure

Access a diversified portfolio of best-in-class private investment partners managing institutional-quality, private infrastructure.

Access a diversified portfolio of best-in-class private investment partners managing institutional-quality, private infrastructure.

Real Assets

Starlight Private Global Infrastructure Pool

Inception-2020

Investment Objective:

To achieve long-term capital appreciation and regular current income by investing globally in private infrastructure and infrastructure related investments and in publicly traded companies with direct or indirect exposure to infrastructure.

Fund Codes

Series A (SLC1102)

Series F (SLC1202)

Series I (SLC1902)

Distribution Frequency

Fixed Quarterly

Investment Objective:

To achieve long-term capital appreciation and regular current income by investing globally in private infrastructure and infrastructure related investments and in publicly traded companies with direct or indirect exposure to infrastructure.

Fund Codes

Series A (SLC1102)

Series F (SLC1202)

Series I (SLC1902)

Distribution Frequency

Fixed Quarterly

Important disclaimer.

The views in this update are subject to change at any time based upon market or other conditions and are current as of September 2, 2024. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Please read the offering documents before investing. Investors should consult with their advisors prior to investing. Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.

Starlight Investments Capital LP (“Starlight Capital”) is the manager of the Starlight Private Global Real Estate Pool, the Starlight Private Global Infrastructure Pool, and the Starlight Global Private Equity Pool (“Starlight Private Pools”). Starlight Private Pools are offered only to “accredited investors” or in reliance on another exemption from the prospectus requirement.

The views in this update are subject to change at any time based upon market or other conditions and are current as of September 2, 2024. While all material is deemed to be reliable, accuracy and completeness cannot be guaranteed.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what Starlight Capital and the portfolio manager believe to be reasonable assumptions, neither Starlight Capital nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Please read the offering documents before investing. Investors should consult with their advisors prior to investing. Starlight Investments, Starlight Capital and all other related Starlight logos are trademarks of Starlight Group Property Holdings Inc.

Starlight Investments Capital LP (“Starlight Capital”) is the manager of the Starlight Private Global Real Estate Pool, the Starlight Private Global Infrastructure Pool, and the Starlight Global Private Equity Pool (“Starlight Private Pools”). Starlight Private Pools are offered only to “accredited investors” or in reliance on another exemption from the prospectus requirement.